Top 4 German REITs: Comparing the Best REITs in Germany

Discover the performance of the top German REITs in this comprehensive analysis. We examine Alstria Office REIT, Deutsche Konsum REIT, Fair Value REIT, and Hamborner REIT, comparing strategies, portfolio sizes, dividend yields, and past returns to help you navigate the German real estate investment landscape.

Key Takeaways

- Explore the 4 German REITs. Therefore, we look at strategy, performance, and other factors.

- Alstria Office REIT: Prime office investments, 108 properties, 4.7 billion euros, pivotal in German real estate.

- Deutsche Konsum REIT: Retail focus, B & C locations, unique strategy, projected yield increase, cautious excitement.

- Fair Value REIT: C-locations, retail & office, 7.4% dividend yield, attractive option for higher returns.

- Hamborner REIT: Urban commercial focus, 66 properties, 7% substantial dividend yield, appealing contender.

- We analyze the returns of REITs in times of real estate boom and show you possible differences and implications for investors.

Introduction: How Good Are German REITs?

Discover the different Real Estate Investment Trusts (REITs) in Germany. We have already delved into the intricacies of REITs and highlighted the differences between German and global REITs. If you are interested in investing in German REITs, a crucial question arises: which German REIT really shines amidst these differences?

Join us on an insightful journey of discovery as we examine and compare the four most important REITs in Germany. By analyzing their strategies, evaluating their portfolio sizes, analyzing their dividend yields, and examining their historical performance, we aim to provide you with a comprehensive perspective that will help you in your decision-making. Our analysis is designed to provide you with a path to identify the most promising German REITs in the confusing landscape of real estate investments.

REIT in Germany 1: Alstria Office REIT

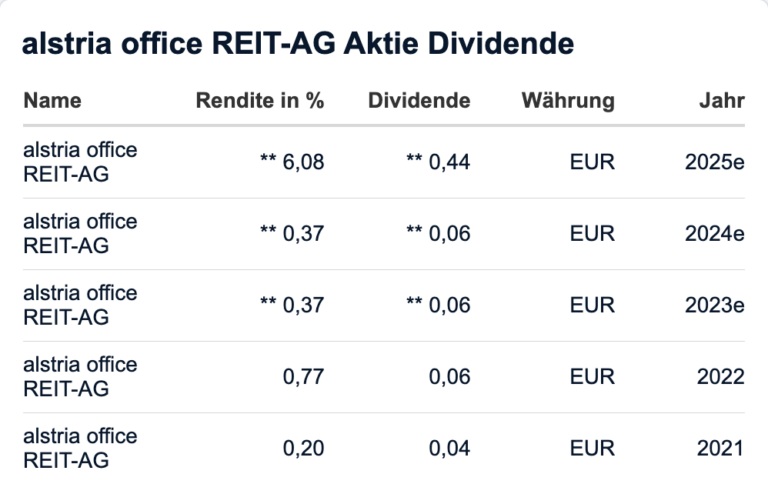

Our journey begins with a close look at Alstria Office REIT, a prominent player in the German REIT landscape. Alstria’s strategic approach revolves around capitalizing on the demand for office spaces in high-profile German cities, including Hamburg, Dusseldorf, Frankfurt, and Berlin. This strategic choice aligns well with the bustling business activities and urban dynamics of these locations.

What sets Alstria apart is its impressive portfolio, housing a substantial collection of 108 properties collectively valued at an impressive 4.7 billion euros. This significant market presence underscores Alstria’s commitment to establishing itself as a prominent real estate player, focusing on a pivotal segment of the market that accommodates diverse businesses and industries.

By concentrating on prime office spaces, Alstria’s approach responds to the modern workplace’s evolving needs and the ever-growing significance of thriving urban centers in Germany’s economic landscape.

REIT in Germany 2: Deutsche Konsum REIT

Moving on to Deutsche Konsum REIT, we delve into a distinct avenue of real estate investment. This REIT stands out for its concentrated focus on retail properties, adopting a strategic approach that targets B and C locations.

While their portfolio may not be as extensive as some competitors, their selection of retail properties in these areas brings a unique and diverse perspective to their investment strategy. By tapping into these locations, Deutsche Konsum REIT aims to capture the essence of commercial activity in less prominent areas, potentially filling a vital niche in the retail market.

Furthermore, the REIT’s projected increase in yield adds an element of intrigue for potential investors. This potential yield increase, estimated to range from five to six percent in 2025, signifies Deutsche Konsum REIT’s determination to enhance returns for its investors.

REIT in Germany 3: Fair Value REIT

Turning our attention to Fair Value REIT, we step into a realm of niche-focused real estate investment. This REIT’s unique approach involves acquiring retail and office properties specifically situated in C-locations. By concentrating on these areas, Fair Value REIT taps into a segment of the market that might be overlooked by others, potentially offering a different avenue for growth and returns.

What’s more, their robust dividend yield of 7.4% sets them apart as an enticing option for investors aiming for potentially higher returns. This attractive yield not only serves as a draw for those seeking income from their investments but also reflects Fair Value REIT’s commitment to generating value for its stakeholders.

This REIT, which operates in the landscape of retail and office properties in C-locations, superficially offers a distinct investment opportunity for individuals looking to diversify their portfolio and explore alternative real estate opportunities. However, when looking at past performance, even this REIT does not perform well, despite the high dividend yield.

REIT in Germany 4: Hamborner REIT

Moving to Hamborner REIT, we delve into a diverse world of commercial real estate investments. With a strategic emphasis on both city centers and suburbs, Hamborner REIT has positioned itself to cater to the distinct demands of different urban environments. Their extensive portfolio comprises 66 properties scattered across Germany, reflecting their commitment to capturing opportunities in various regions.

What adds to their allure is the robust dividend yield of approx. 7%, making them a compelling contender for investors seeking income-oriented options. This notable yield underscores their dedication to providing a steady stream of returns to shareholders, which can be particularly appealing in today’s economic landscape.

Hamborner REIT’s approach underscores its adaptability to the ever-changing preferences of tenants and businesses and positions it as a major player in commercial real estate in Germany. Nevertheless, it must unfortunately also be said here that the performance, although very good compared to the other REITs, is generally very bad.

Historic Performance vs. Real Estate Boom

Examine the historical performance of these REITs against the backdrop of the flourishing real estate landscape in Germany. As property prices across the country experience a remarkable rise, it is interesting to compare this phenomenon with the returns offered by these REITs. The discrepancy between rising property prices and the lackluster performance of German REITs raises critical questions about the harmony between these investments and investor aspirations.

This divergence prompts a deep reflection on whether these REITs are indeed converting the burgeoning real estate market into lucrative returns for their shareholders. It prompts a reassessment of the strategies and management practices employed by these REITs to ensure that they are realizing the full potential of the real estate boom and, in turn, providing investors with the substantial returns they expect.

Conclusion: Insights for Informed Investors

In the complex landscape of German REITs, investors can chart their course with confidence using the insights gained from examining each provider’s strategy, portfolio, dividend yields, and returns. This comparative research provides a valuable toolkit for those looking to enter the world of real estate investment in Germany.

By understanding the unique focus of each REIT – from office buildings in prime locations to retail and office properties in diverse urban landscapes – potential investors can tailor their selection to their risk tolerance and financial goals. Moreover, assessing historical performance against the backdrop of a booming real estate market highlights the complexity underlying these investments. It becomes clear that thorough research, due diligence, and a forward-looking perspective are essential to navigate the dynamics of the real estate sector.

Armed with these insights, potential investors can navigate the German REIT space with a deeper understanding and make informed investment decisions that align with their financial perceptions and expectations.

Pingback: Die 4 besten deutschen REITs: Die besten REITs im Vergleich

Pingback: Why Real Estate Security Tokens Are Better Than REITs