The German Real Estate Market: Is a Crash Happening Now?

In 2022, German real estate made headlines with a 0.71% price drop. Is it a crash or an opportunity? Let’s uncover the truth.

Key Takeaways

- German property prices soared over 40% in 4 years, a remarkable feat even with inflation.

- A 0.71% dip in 2022 property prices, but 6.9% inflation means a 6.2% nominal rise.

- Compare interest rates with the 6.9% inflation rate for a real perspective on returns.

- Our community portfolio showcases the power of real estate investment despite rising interest rates.

Introduction

In 2022, the real estate world was abuzz with reports of a 0.71% decrease in German property prices. For some, this immediately raised alarms and triggered concerns of an impending real estate crash. However, as seasoned investors know, things in the real estate market often go much deeper than sensational headlines.

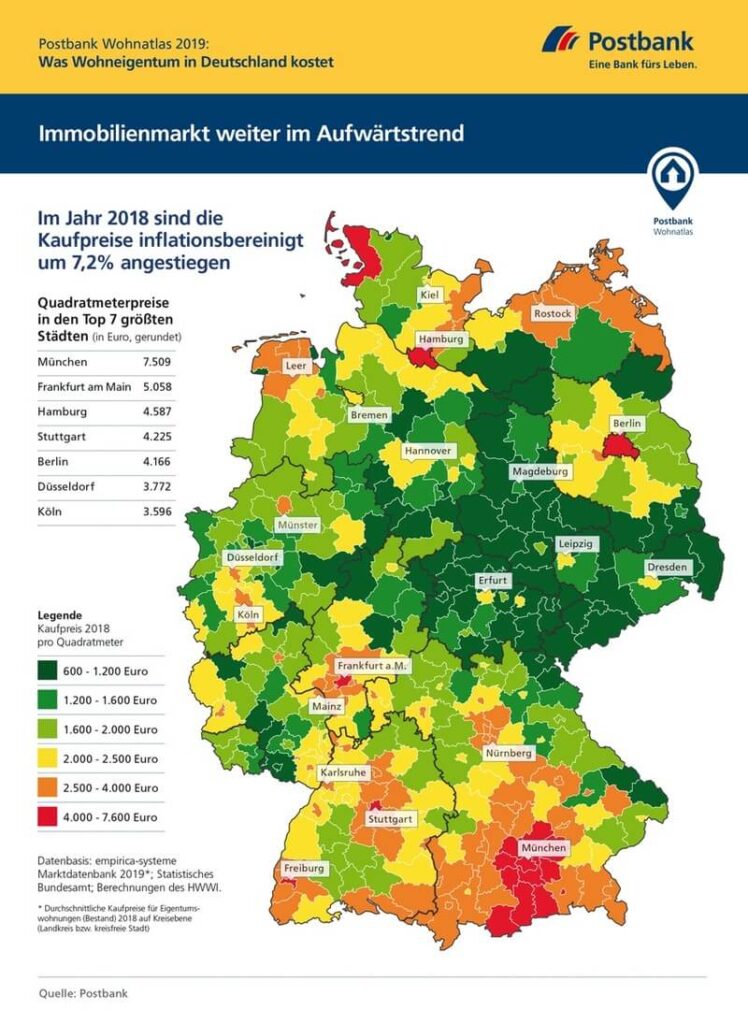

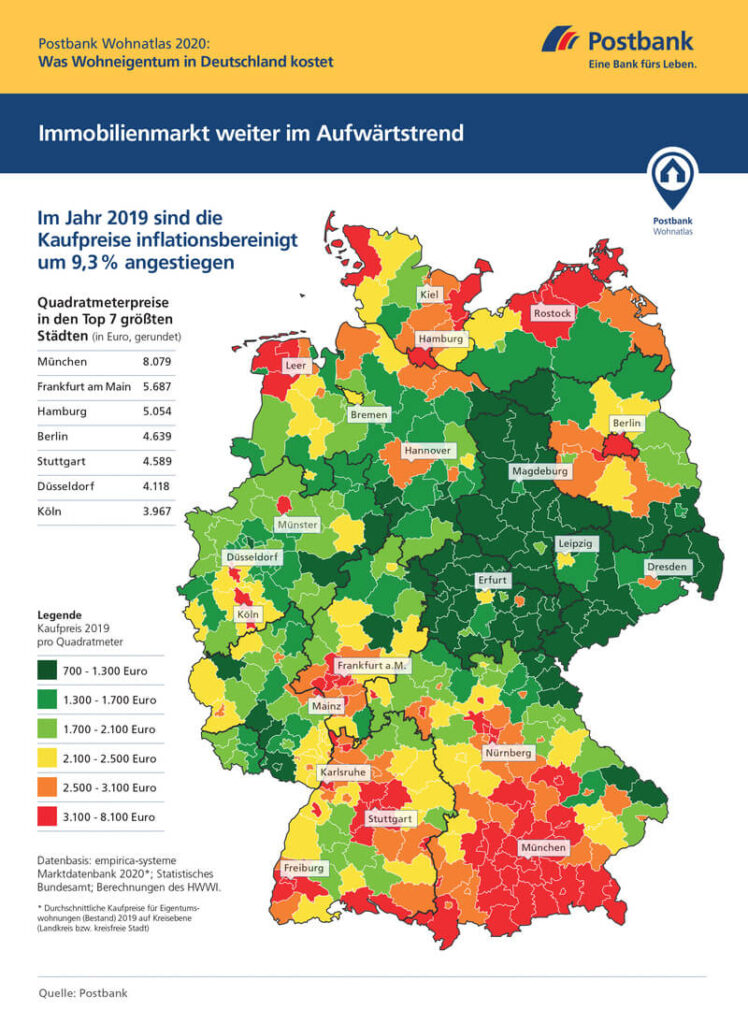

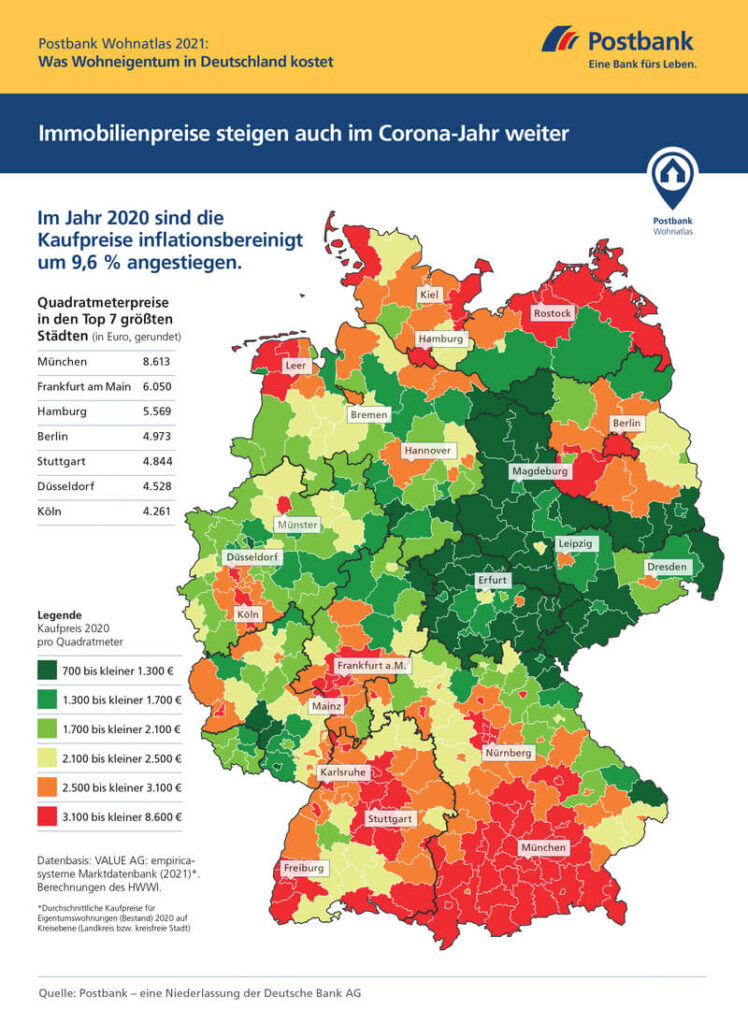

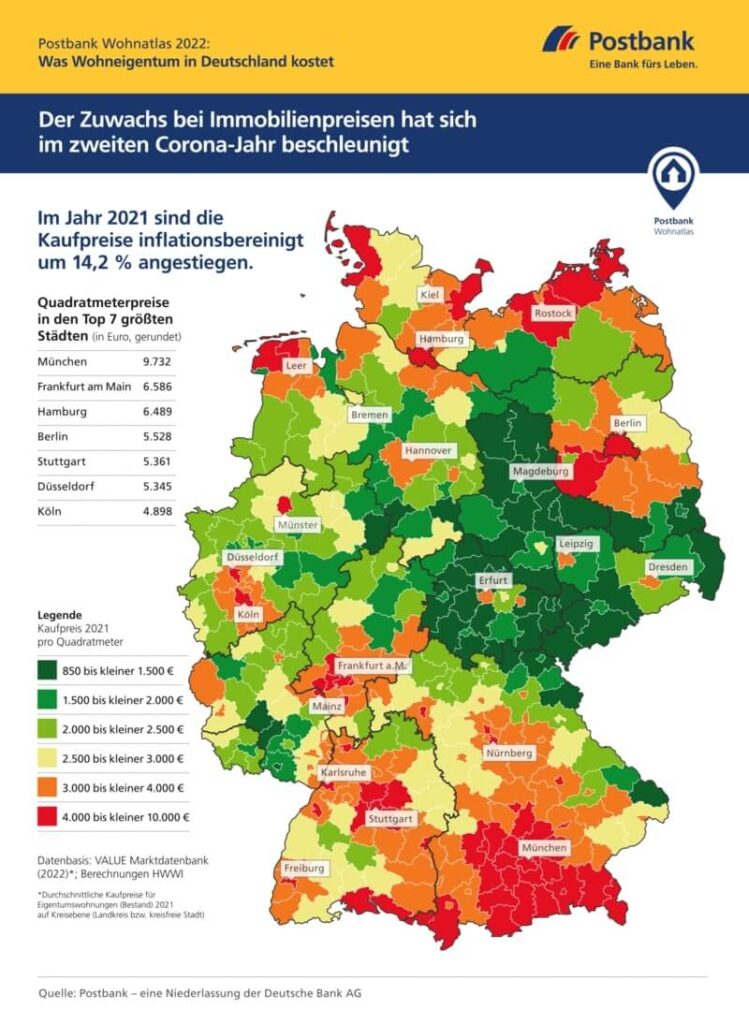

The German real estate market has seen an impressive historical trajectory, with property prices experiencing substantial growth over the years. Postbank’s annual Wohnatlas report, which tracks average property price development in Germany, showcased an impressive 40% price increase over just four years, even when factoring in inflation.

Moreover, when examining the 0.71% decrease, it’s crucial to consider the impact of inflation. The German inflation rate for 2022 was 6.9%, significantly higher than in previous years. This means that property prices, when looked at before inflation, actually increased by 6.2%. These figures paint a different picture and reveal that the market still holds strong potential for investors, especially when compared to other investment options like the stock market.

So, is the German real estate market crashing? Let’s explore further to uncover the nuances behind the headlines.

Historic Property Returns in Germany

Before jumping to conclusions about a potential real estate crash in Germany, it’s essential to examine the historical context. Over the past 4 years, the German property market has displayed remarkable growth. In 2018, property prices increased by 7.2%, followed by a 9.3% surge in 2019, a 9.6% rise in 2020, and an astonishing 14.2% surge in 2021. This cumulative increase amounts to over 40% in just four years, even when accounting for inflation.

These figures highlight the robustness of the German real estate market, which has consistently delivered impressive returns to investors. Even though 2022 saw a nominal 0.71% decrease in property prices, when inflation is factored in, property prices rose by 6.2%. This means that property investments in Germany when viewed in the broader context, have remained highly profitable, particularly when compared to other investment avenues like the stock market.

So, while the headlines may raise concerns, a deeper examination of the historical trends suggests that the German real estate market is far from crashing.

German Property Prices in 2022

Let’s address the headline news: the 0.71% decrease in German property prices in 2022. However, there’s an important nuance to consider. When we factor in the inflation rate of 6.9%, the picture changes significantly. In reality, property prices didn’t decrease but rather rose nominally by 6.2%.

This perspective is crucial because it highlights the impact of inflation on investment returns. In an environment with rising inflation, which many countries worldwide are experiencing, the real value of money decreases over time. Therefore, even though the nominal value of assets may appear to decline, their purchasing power can remain steady or even grow.

In the case of German real estate, despite the nominal drop in prices, the assets have actually retained their value and continued to provide positive returns when viewed in light of inflation. This is a notable advantage for real estate investors, especially when compared to other investment options that may struggle to keep pace with rising prices.

Mortgage Rate vs. Inflation Rate

To truly grasp the significance of these numbers, it’s essential to compare the inflation rate with prevailing interest rates. Currently, within the European Union, nominal interest rates range from approximately 3.73% for flexible savings accounts to as much as 5% for fixed-term savings. However, when you consider the context of a 6.9% inflation rate, the implications become clear.

In simple terms, with an inflation rate outpacing interest rates, you’re effectively losing almost 2% of your hard-earned money each year in real terms. This scenario underscores the challenge of preserving and growing wealth in an environment where inflation erodes the purchasing power of your savings.

Here’s where real estate investments shine. Real estate investors often use leverage, typically in the form of mortgages, to acquire properties. This leveraging strategy can be particularly advantageous during periods of high inflation. As inflation erodes the real value of debt, investors find their mortgage balances decreasing in real terms, effectively reducing their debt burdens. Consequently, this can enhance the overall returns on real estate investments, making them a potentially attractive option in an inflationary economic landscape.

Example: Return of Our Community Portfolio

Let’s put these concepts into perspective with a real-life example: our community portfolio investment. This case illustrates why real estate continues to be an appealing investment option. Despite the backdrop of rising interest rates, our 4% mortgage rate is starting to look like a steal, especially when viewed through the lens of inflation steadily chipping away at the value of your money.

In just one year since we acquired the property in Dusseldorf, our investment has yielded substantial profits. This impressive performance comes even before we factor in some key advantages yet to be realized. We haven’t even begun to leverage the full potential of this investment.

These initial results highlight why real estate is often viewed as a robust hedge against inflation. While other investments might struggle to keep pace with rising prices, the dynamics of real estate, particularly when used strategically with leverage, can lead to wealth preservation and growth even in inflationary times. So, despite the evolving economic landscape, the fundamentals of real estate investing remain robust, making it a compelling choice for savvy investors.

Do you want to profit from the rising real estate market in Germany? With our real estate security tokens you can conveniently invest in the German real estate market.

Should You Invest in Real Estate Right Now?

Is it the right moment to venture into German real estate? Absolutely, with a word of caution. Smart investing requires a strategic approach. The days of haphazard property purchases and the hope for instant riches are behind us.

At the GermanReal.Estate Marketplace, we provide a means to make informed investments in top-notch German real estate, even in these uncertain times. With potential returns reaching an impressive 12%, it remains a savvy decision. So, if you’re contemplating real estate investments, remember that doing it right can still yield substantial rewards. Happy investing!

Pingback: Der deutsche Immobilienmarkt: Kommt es jetzt zu einem Crash? | GermanReal.Estate