Is Germany in a Real Estate Bubble?

Amidst the debate on a German real estate bubble, this analysis delves into property price surges, bubble inception, and whether it’s time to invest.

Key Takeaways

- Explore Germany’s real estate market, dissecting factors behind rising property prices, and debating bubble existence.

- Development of real estate prices: Analyse the increase in property prices from 2015 to 2022 and reveal the hidden dynamics.

- How a Bubble Starts: Real estate bubbles are complex, with stages beyond simple historical price comparisons.

- Why Prices Increased: Factors like global investment appeal, stability, and urbanization drive Germany’s property price growth.

- Why a Bubble Bursts: Bubbles can burst due to buyers’ reluctance, oversupply, and external factors like rising rates.

- Pro & Con Arguments: Debate rages over a bubble, citing steep price increases and robust mortgage regulations.

- Buy Now or Wait: The decision hinges on unpredictable factors, making careful consideration essential for investing.

Introduction

The specter of a real estate bubble looms large over Germany. As property prices continue their seemingly unstoppable ascent, a debate rages about whether this market is in the throes of a speculative bubble. In this episode of the GermanReal.Estate Blog, we embark on a data-driven exploration of the German real estate landscape, dissecting the factors contributing to soaring property prices and weighing the arguments for and against the existence of a bubble.

Germany’s real estate market has been on a remarkable upward trajectory, with significant price increases observed in recent years. However, the question that lingers is whether this growth is sustainable or if it’s a precursor to a market correction.

To unravel this complex issue, we’ll delve into the five key stages of a real estate bubble, analyze Germany’s property price development, and examine the catalysts behind these substantial price hikes. We’ll also explore the factors that could potentially lead to a bubble burst, such as rising mortgage rates and increased supply. Finally, we’ll present arguments both for and against the existence of a real estate bubble, offering insights to help you navigate this dynamic market landscape.

Whether you’re a prospective buyer or simply curious about the state of German real estate, this analysis will provide valuable insights into one of the most debated topics in today’s property market.

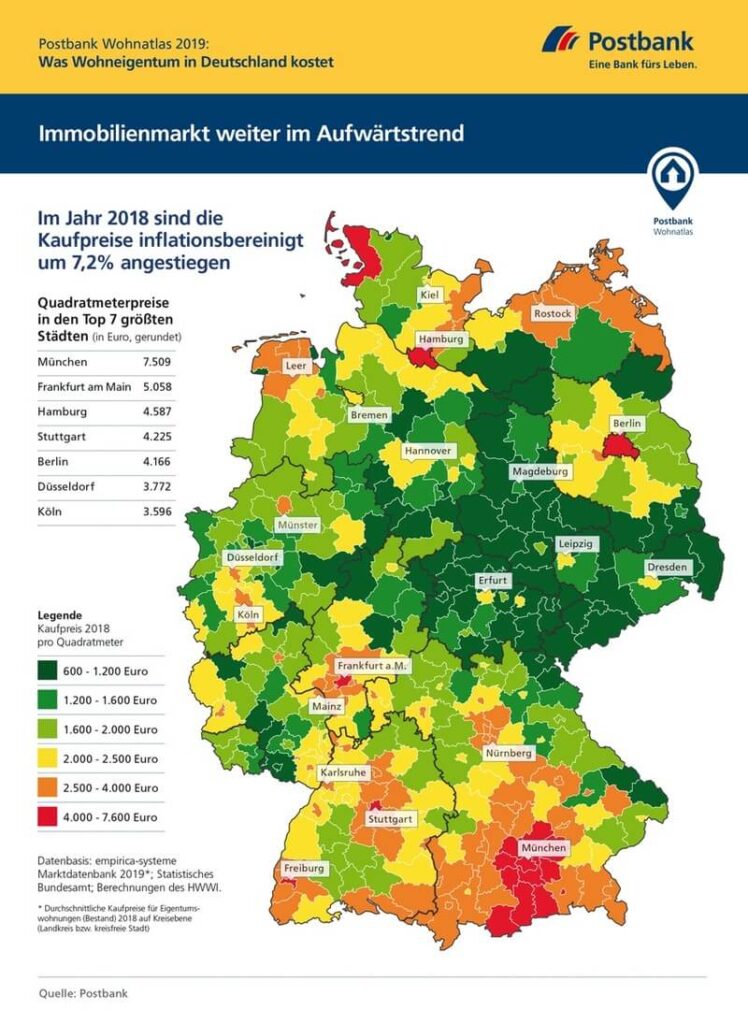

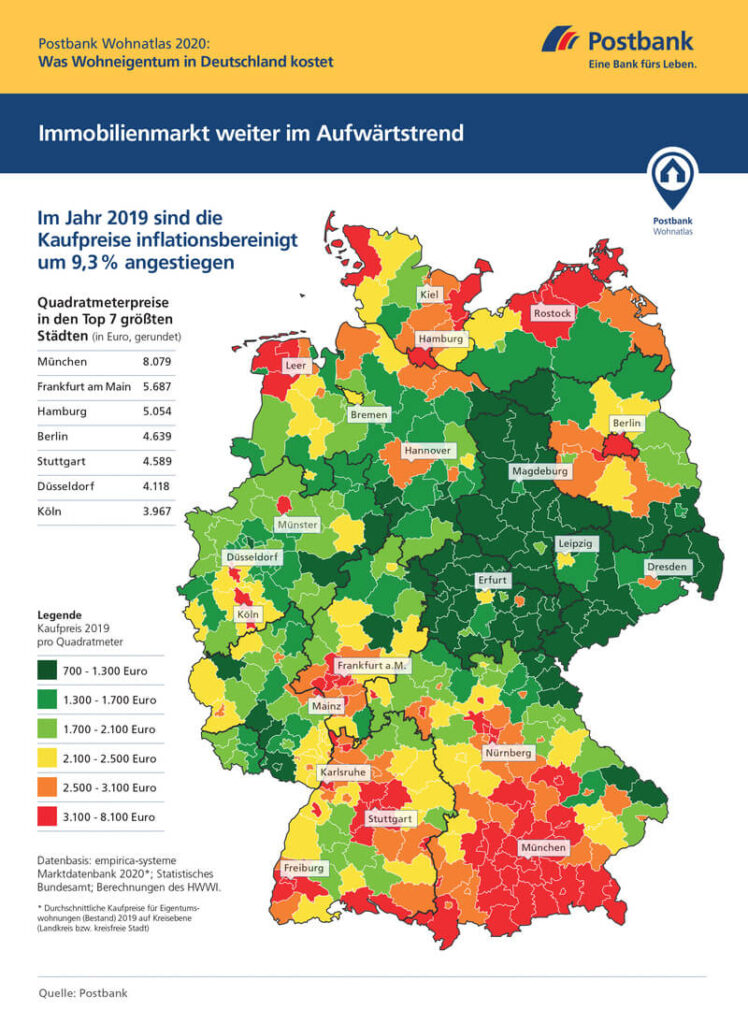

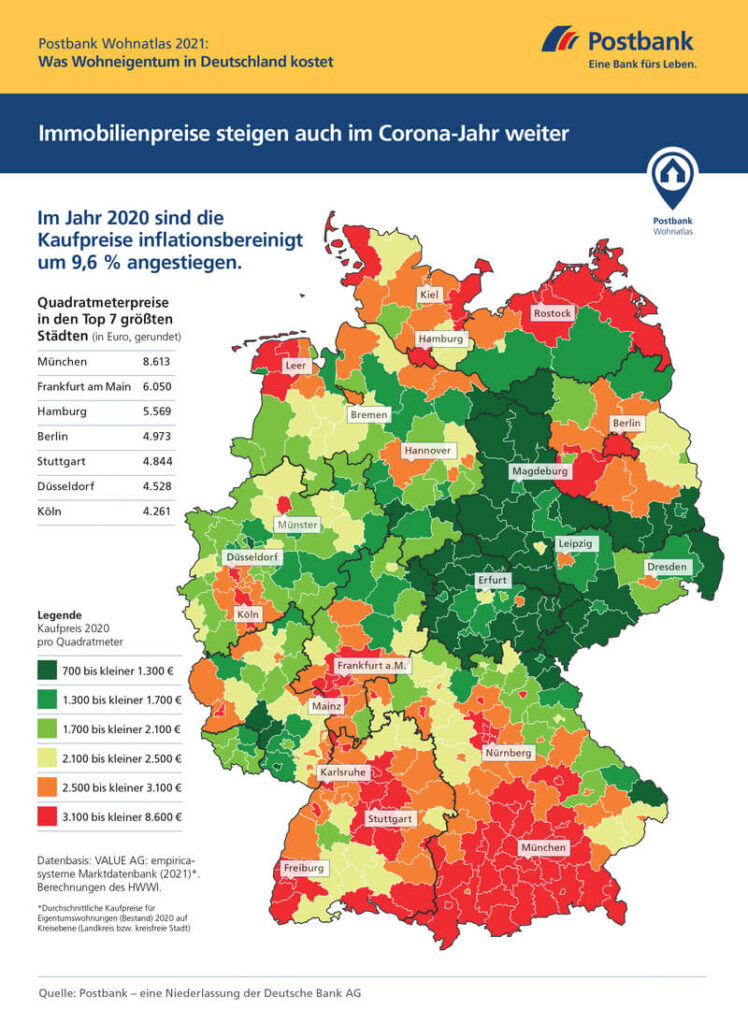

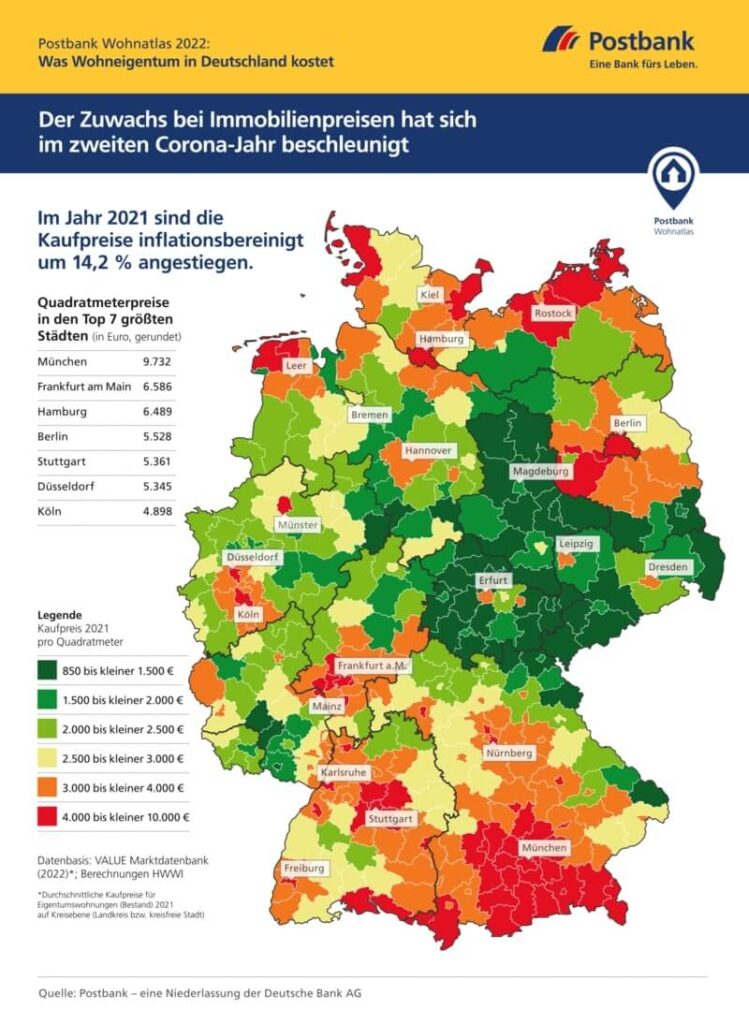

Property Price Development in Germany

To fathom the current situation, we must first examine property price development. Over the past few years, Germany has experienced a remarkable property price surge. Statistically speaking, the index of rents in Germany increased by 8.4% from 2015 to 2022, averaging just over 1% year over year. On the surface, these figures could suggest a thriving and sustainable market. But before we draw conclusions, we must probe deeper into the forces behind this price surge.

Rising property prices, especially in urban centers like Berlin, Frankfurt, and Munich, have indeed been a noticeable trend. However, it’s essential to dissect the factors driving this growth. To do so, we need to consider elements such as demand, supply, economic health, and interest rates. While nominal property prices may have surged, a comprehensive analysis must also consider real prices adjusted for inflation.

By scrutinizing these underlying factors, we can gain a more nuanced understanding of the dynamics at play in Germany’s property market and assess whether the current price development is sustainable or a precursor to a market correction.

How a (Real Estate) Bubble Starts

Real estate bubbles are born from a complex interplay of factors, and their emergence isn’t as straightforward as many presume. The conventional narrative often revolves around historical price comparisons, but this oversimplification misses the intricacies. In reality, bubbles originate from a series of steps. To understand whether Germany is in one now, we must analyze these stages and the events leading up to them.

Bubbles begin with a surge in demand surpassing available supply, leading to sellers asking for increasingly higher prices. This uptick in property prices doesn’t necessarily indicate a bubble; it can respond to genuine market conditions, such as low-interest rates and a strong economy. Assessing whether this is a bubble or a normal market fluctuation requires a deeper dive into the market’s structural aspects.

To truly understand the situation, we need to explore why property prices have risen significantly in Germany, looking at factors like interest rates, economic health, and demand-supply dynamics. This nuanced perspective is essential to determine whether the market is in a bubble or merely experiencing a period of robust growth.

Why Property Prices Increased So Much

A multitude of elements has contributed to the astonishing price growth in Germany. The country’s allure as a safe haven for international investors amid global economic uncertainty is a significant driver. Moreover, the tangibility and stability of real estate have made it a preferred investment choice. Demographic shifts, such as urbanization, have further amplified housing demand, particularly in major cities.

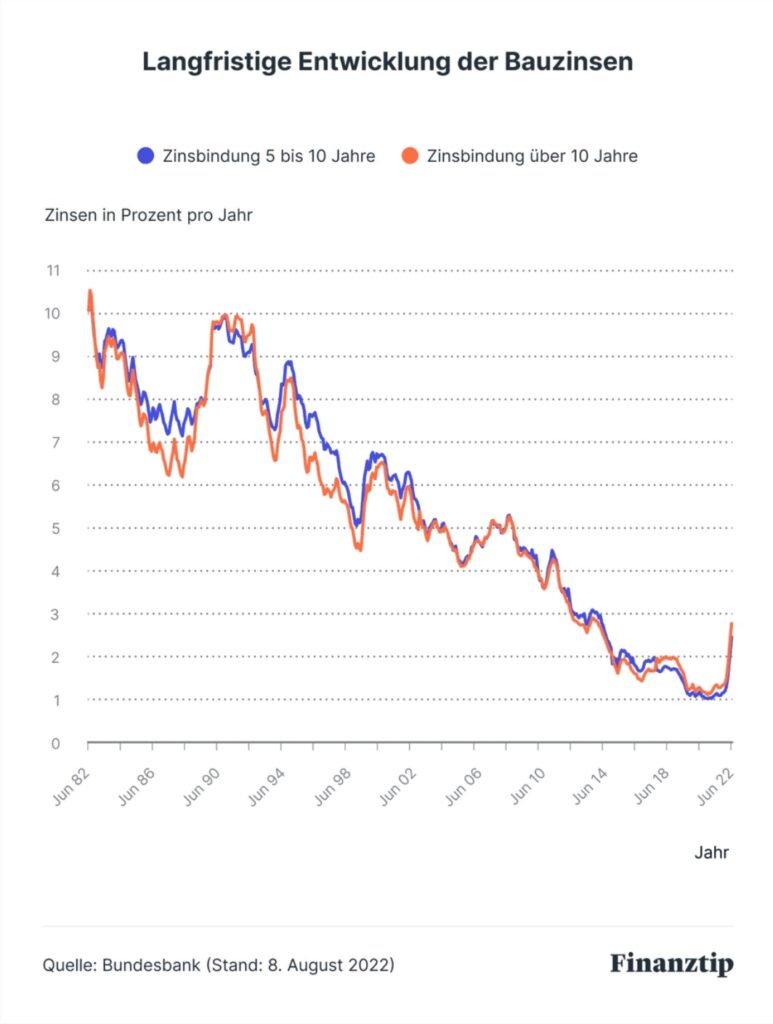

Low interest rates, a long-standing feature of the European Central Bank’s monetary policy, have made borrowing cheap and fueled the property market. This combination of factors has propelled demand and, subsequently, property prices to remarkable heights.

Furthermore, Germany’s robust economy and job prospects have drawn people from around the world, creating additional demand for housing. Cities like Berlin, Frankfurt, and Munich, with their vibrant economies and cultural attractions, have been at the forefront of this urban migration, driving up property prices in these areas even more.

Understanding these drivers is crucial to assessing whether the German property market is in a bubble or experiencing a genuine growth phase.

Do you want to invest in real estate without buying a property directly? Then go to our marketplace!

Why a (Real Estate) Bubble Is Bursting

Real estate bubbles, by nature, pose the risk of bursting. The fifth stage in the bubble cycle entails buyers being unwilling to pay the inflated prices, which leads to a market correction. An oversupply of properties can also trigger a downturn. While some argue that Germany’s real estate market has reached this stage, others contend that the market still has potential for growth. Factors such as increasing mortgage rates and international events, like the Ukraine conflict, have introduced uncertainties. Ultimately, the answer to whether the bubble has burst remains elusive.

The recent increase in mortgage rates, driven in part by global events, has made property ownership more expensive. This shift may discourage some potential buyers, especially in a market where prices have already surged significantly. However, the true extent of the impact of these changes on the German property market is a matter of ongoing debate.

Furthermore, Germany’s housing shortage remains a critical issue, especially in major cities. Even a slowdown in price growth doesn’t necessarily indicate a bursting bubble but might signify a market correction towards more sustainable levels. The future trajectory of the real estate market hinges on a complex web of economic, political, and social factors.

Pro Bubble Vs. Con Bubble Arguments

The debate surrounding a German real estate bubble is far from one-sided. Proponents of the bubble theory point to staggering property price increases, particularly in major cities like Berlin, Frankfurt, and Munich. The German Bundesbank and Swiss bank UBS have deemed properties in some cities to be significantly overvalued, with up to a 40% premium. Conversely, opponents argue that Germany’s mortgage lending regulations prevent the subprime lending crisis that triggered the 2008 US housing market crash. Most German mortgages have fixed rates for 10 to 15 years, potentially delaying the impact of recent interest rate hikes. The outcome of this debate remains uncertain.

While some indicators suggest that the German real estate market may be overheating, it’s essential to consider the broader economic context. Germany’s economy, though facing uncertainties, remains robust compared to many other countries. This economic stability could continue to support the real estate market, even in the face of potential headwinds.

Ultimately, the decision to buy property in Germany hinges on a range of personal factors, including individual financial circumstances and long-term goals. While the debate over a bubble persists, there are still opportunities for well-informed and strategic real estate investments in the country.

Should You Buy a Property Right Now?

The decision to invest in German real estate today hinges on a multitude of variables, many of which are unpredictable. Mortgage rates, inflation, construction rates, salaries, net migration, and more all interplay in the complex real estate market equation.

While 2022 and 2023 witnessed a slowdown, it’s unlikely that all issues will resolve swiftly, ushering in the return of double-digit price increases. Nevertheless, opportunities persist, albeit requiring deeper exploration to unearth. For those interested in investing in German real estate, the GermanRealEstate Marketplace offers an accessible entry point, with a minimum investment of just €100. The path ahead in the German real estate market remains both challenging and promising, demanding careful consideration before making investment decisions.

Pingback: Befindet sich Deutschland in einer Immobilienblase? | GermanReal.Estate

Pingback: Real Estate Bubble Index – All You Need To Know