2 Reasons For Rising German Property Prices

Key Takeaways

- In early 2022, the 10+ year rally of real estate prices in Germany started to slow down significantly

- Out of the 4 major economic factors that determine property prices, 2 indicate falling prices or even a market crash

- With the German population being at an all-time high, the demand for living space keeps growing and growing

- Germany is losing +100.000 flats every single year because we are not building or renovating enough

Introduction: The German Real Estate Market Changed

We introduced the 4 major economic factors that influence (German) real estate prices in the last GermanReal.Estate blog post. The first 2 factors (mortgage interest rates & incomes) indicate that real estate prices in Germany will fall, maybe even that the entire German real estate market will crash. The other 2 factors that will be discussed in this blog post, speak for rising german property prices.

Will the German real estate rally continue or is the party over and properties are not affordable for the German population anymore? In 2020, property prices in the average German location rose by +9,6% after inflation. In 20201, property prices rose by another 14,2% after inflation. Growth rates like these have many people worried that the market will turn eventually and the “bubble” will burst.

With the World Bank expecting a global recession in 2023, rising mortgage interest rates, the war in Ukraine, rising inflation in the Euro area, etc it is not looking positive for the German real estate market (at first sight). That is why this article will take a deeper look to find economic factors that will stand against the negative news. The real question is: Will these factors be enough to support the German real estate market? You will be able to form your own opinion after reading through the article.

Reason 1 For Rising German Property Prices: Demographics

The German population has been rising consistently since World War 2. Especially in the 1960s, the 1990s after the German reunion, and in the 2010s after the global financial crisis, a lot of babies have been born. That is why today, the German population is at an all-time high with about 83,2 million people (at the end of 2021). For real estate investors, it is more important what will happen to the population in the future, than what happened in the past.

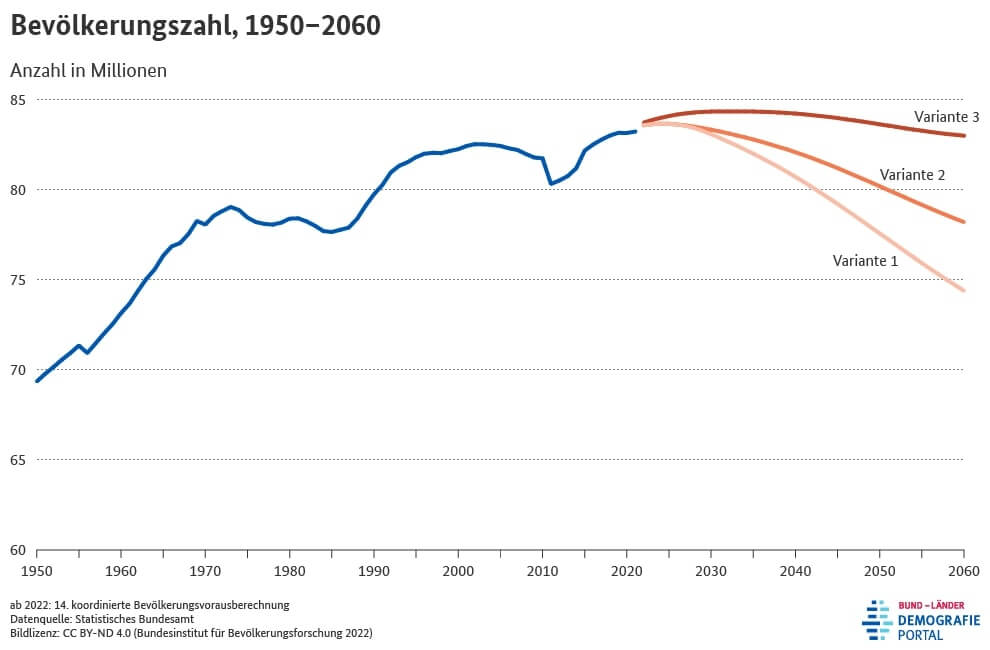

Nobody can know exactly how the German population will develop in the future, but there are certain projections from the German Demographics Portal. Variant 1 in the graphic below shows the future development of the German population with absolutely no migration to Germany. As more people are dying than babies are being born, the German population would be shrinking fast without any migration.

With a little migration to Germany, the population would develop like in Variant 2. As there was always migration to Germany since the 1950s (up to 1 million people per year (net) as shown in this chart), it is extremely unlikely that the German population would shrink as fast as in variant 1. With little migration to Germany, the population would still shrink slowly over the next years and decades.

Migration will have a tremendous influence on the development of the German demographics. With a lot of migration (like in the year 2015 with +2 million), the German population would be growing for the next 10 and 20 years until the year 2040. Everything after that is highly speculative anyway. Trying to predict demographic changes over 10 or 20 years might lead to valid results. Trying to predict population changes over 40 years seems highly speculative given the fact that many variables are involved.

No matter which population variant you guess is the correct one, there will always be demographic trends driving up the real estate prices of certain properties. Always remember: Population growth is only one aspect of demographic change. There are a lot more variables involved in order to determine the development of real estate prices:

- The amount of people living in cities will grow continuously. The graphic shows that the German population went from 68,1% in cities in the 1950s to 78,6% living in cities in the 2030s. So even if the overall German population could be shrinking (like in variant 1), the percentage of people in cities will grow and therefore make properties in the top German locations more valuable.

- While the German population ranked in age groups looked more like a pyramid in the 1950s (as seen here), the pyramid shape slowly shifted as fewer babies were being born over the decades. This shift makes real estate catered to senior living (seniority homes, retirement homes, nursing homes, etc) more valuable.

There is no “one” German real estate that will be a good or bad investment going forward. The goal of investors has to be to diversify with different investment properties. That was our goal when creating GermanReal.Estate, to give investors the chance to invest in many different rental properties with the blockchain.

What is difficult to do when buying real physical properties yourself (because of high prices), is easy to do when investing in real estate security tokens on our GermanReal.Estate marketplace. Alternative ways to invest in real estate in Germany aside from real estate security tokens are REITs, real estate ETFs, or real estate crowdfunding.

Invest in many different (German) real estate trends here:

Reason 2 For Rising German Property Prices: Supply

The last major economic factor that influences (German) real estate prices is at the same time the most important one to everyone believing in the market economy. The law of supply & demand has been proven right and right again over hundreds of years. When trying to predict future property prices, you just need to compare how much living space is created compared to how much living space is needed.

If a country has a supply surplus of living space (more supply than demand), sooner or later property prices and rents have to go down as tenants and potential buyers have many options to choose from. There is no reason to pay high property prices or high rents. If a country is not creating enough living space, property prices and rents have to go higher and higher the more the demand outgrows the supply (excess demand).

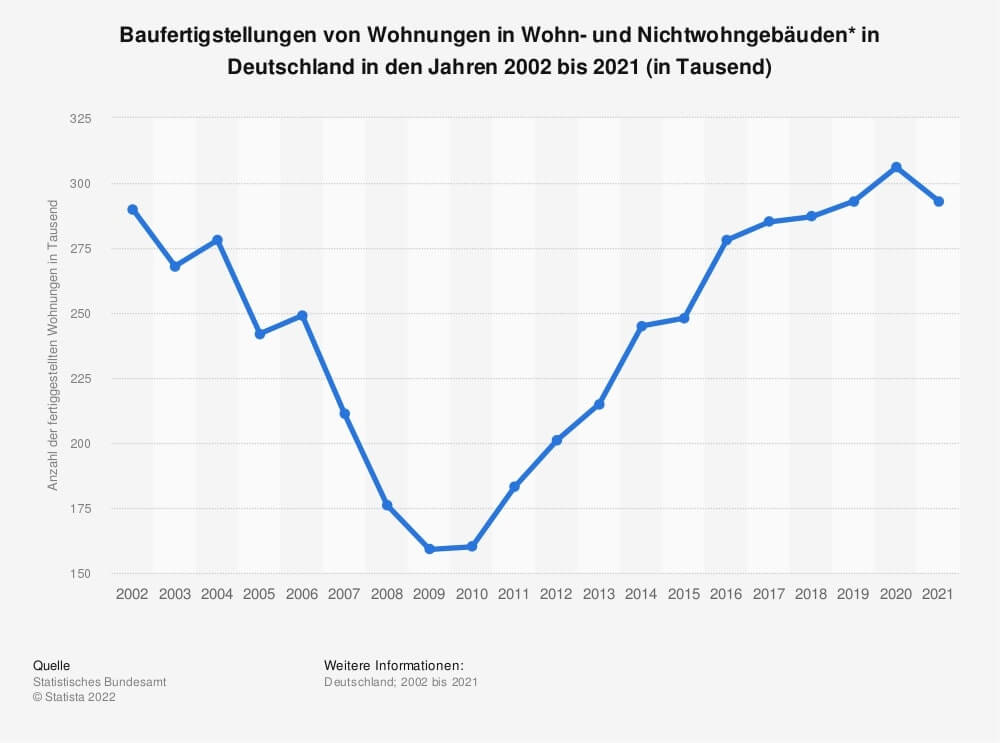

In order to keep the supply of living space leveled, the German government plans to create 400.000 flats every year. Given the average lifespan of a property (±100 years), Germany needs to build, modernize, or renovate 400.000 flats every year just to keep the supply of living space at 0. Factoring in that the German population is at an all-time high right now, Germany would need a lot more than 400.000 flats each year in order to satisfy the demand.

To see how close Germany came to building 400.000 new flats every year, let us take a look at the graphic above that shows how many flats Germany has really been building over the last 20 years. In 2021, Germany didn’t even manage to create 300.000 flats. To make things worse: In the first half of 2022, even -2,1% fewer building permits were granted in Germany, making it extremely unlikely that Germany will reach its goal to build 400.000 flats in 2022.

Realistically speaking, Germany is losing at the very least 100.000 flats each year for the last 20 years. 300.000 flats were built just once (2020). It seems more realistic that Germany creates 250.000 each year when looking at the graphic above. Resulting in -150.000 flats each year, -1,5 million flats in 10 years, or -3 million flats over the last 20 years. Germany is missing at least 3 million flats.

Are you still wondering why property prices or rents in Germany have been exploding? The German population has been growing consistently over the last 20 years, meaning the demand for living space has been growing accordingly. At the same time, Germany has been losing on a realistic basis about 150.000 flats each year, lowering the demand. How are property prices supposed to go down or “crash” with these numbers?

Conclusion: What Will Happen To German Property Prices?

German property prices are determined mainly by 4 major economic factors. Before 2022, all 4 of these economic factors indicated the German real estate market will continue to grow. At the beginning of 2022, the 2 factors mortgage interest rates and incomes started to turn, meaning that the years of growth might be over.

The other 2 economic indicators (demographics & supply of living space) lead to the conclusion that property prices in Germany will continue to rise. If you believe in the market economy value the law of supply and demand (like us), it seems impossible that real estate prices in Germany will go down significantly over the long term. Some properties in some regions might lose value (become affordable again and therefore generate higher passive income), but the overall German real estate market will stay strong.

In order to help the German real estate market out of this misery, there is only one thing we can do so that rents and property prices will normalize going forward. Companies in the real estate industry (especially property developers) need money so they can build more living space. If you want to support the cause while earning a nice return for yourself by investing in tokenized real estate, check out how you can help property developers on our marketplace.

Pingback: 2 Gründe für steigende deutsche Immobilienpreise - GermanReal.Estate

Pingback: How Can I Earn Money On GermanReal.Estate? - GermanReal.Estate

Pingback: Will The German Housing Market Crash? - GermanReal.Estate

Pingback: How To Register As Investor - GermanReal.Estate

Pingback: Mönchengladbach: Welcome Home Security Token - GermanReal.Estate

Pingback: Why Are We Using The Blockchain Technology? - GermanReal.Estate

Pingback: Security Token - GermanReal.Estate

Pingback: Blockchain - GermanReal.Estate

Pingback: Benefits Of Tokenized Real Estate - GermanReal.Estate

Pingback: Special Purpose Vehicle (SPV) - GermanReal.Estate

Pingback: How Are Returns On GermanReal.Estate Taxed? - GermanReal.Estate

Pingback: Global Real Estate Crash In 2023? - GermanReal.Estate

Pingback: Location Ranking (A, B, C & D) - GermanReal.Estate

Pingback: Passive Income & Real Estate: Is That Possible? - GermanReal.Estate

Pingback: How Inflation Impacts Real Estate Investors - GermanReal.Estate

Pingback: REITs In Germany - GermanReal.Estate

Pingback: Real Estate Bubble Index - GermanReal.Estate

Pingback: Real Estate Crowdfunding | GermanReal.Estate

Pingback: Real Estate With No Money | GermanReal.Estate

Pingback: Best Real Estate Locations In Germany Until 2030 | GermanReal.Estate

Pingback: 5 Tips for Successful Real Estate Investing in 2023: Expert Advice

Pingback: The Truth About the German Real Estate Boom: Supply, Demand, and Growth

Pingback: The Rise and Fall of Vonovia - Europe’s Top Real Estate Company | GermanReal.Estate