How To Get Rich With Real Estate (in Germany)

Embarking on a real estate wealth journey? Let’s delve into the German Economic Institute’s podcast-backed insights.

Key Takeaways

- Understanding the wealth distribution reveals both highs and lows in Germany’s economic tapestry.

- Start small, invest in rental properties for tax benefits, then consider homeownership.

- Real estate ownership significantly contributes to wealth, a trend evident across income brackets.

- From first property to the top 10%, strategic real estate investment is the key to wealth.

Introduction: How To Get Rich With Real Estate

Embarking on a quest for financial prosperity through real estate in Germany? Join us as we dissect insights gleaned from the German Economic Institute’s podcast, a treasure trove backed by data from the German Bundesbank. Diving deep into the intricate realm of real estate wealth, this guide aims to distill scientifically-backed concepts from social media myths.

From the average vs median net worth of German households to the country’s homeownership landscape, we unravel the intricacies guiding your path. Together, we’ll explore how real estate ownership correlates with affluence and unveil a three-step roadmap to guide you from initiating your real estate journey to potentially joining the ranks of Germany’s wealthiest households. Ready to uncover the secrets of getting rich with real estate in Germany? Let’s dive in.

Average Vs Median Net Worth Of German Households

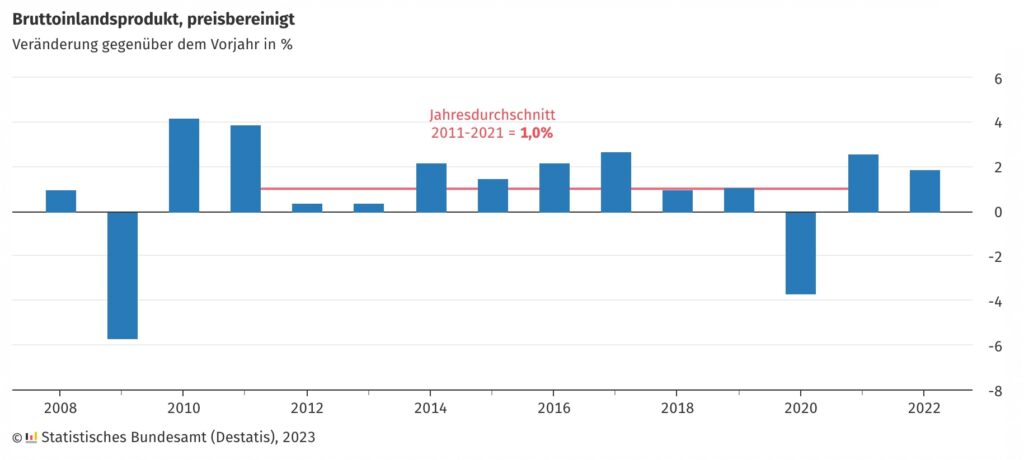

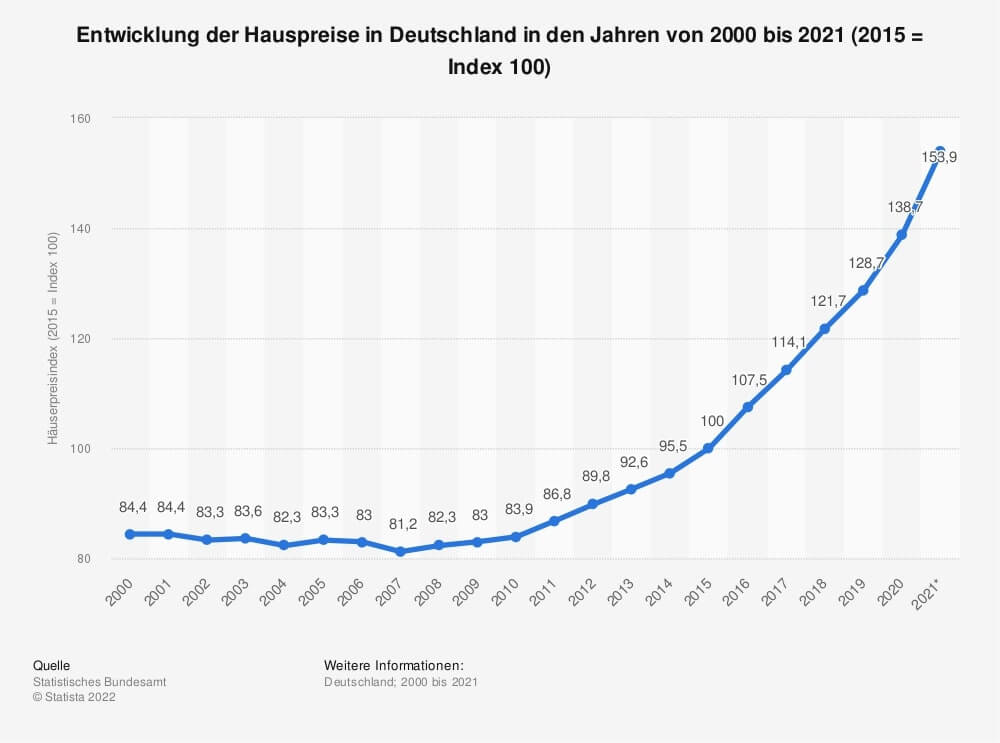

In order to navigate the complicated terrain of personal finance in Germany, it is important to understand the dynamics of household net wealth. As the podcast from the German Economic Institute shows, the average net wealth of German households has risen to an all-time high of €316,500. The median, an important indicator for assessing the distribution of wealth, stands at €106,600.

This divergence emphasizes the pronounced inequality in wealth distribution, which is exacerbated by the influence of outliers, including billionaires, on the average value. Analyzing both benchmarks not only highlights the unequal economic structure in Germany but also provides individuals with a comprehensive overview of their financial standing compared to their peers. In this landscape of financial entanglements, a nuanced understanding of wealth dynamics is essential for informed decision-making.

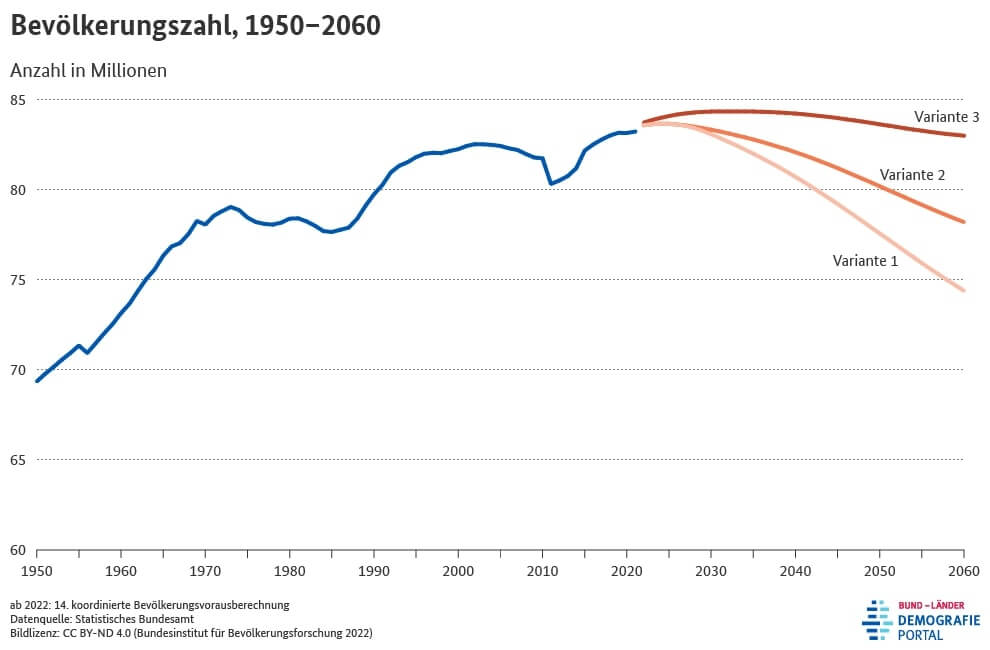

Homeownership Rate of Germany

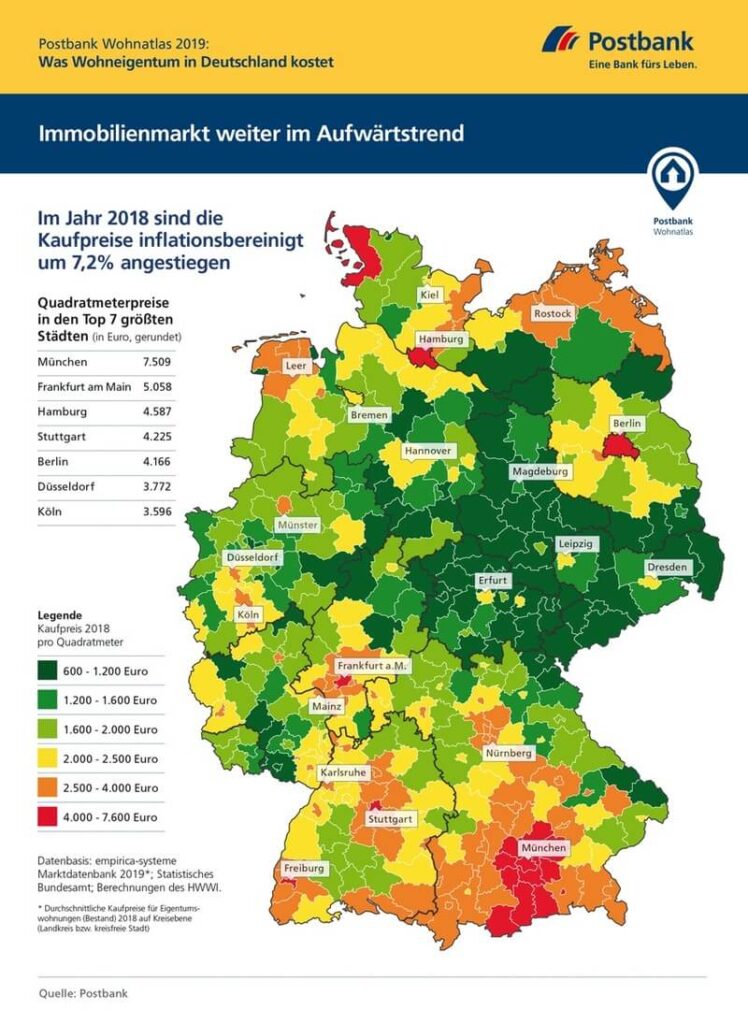

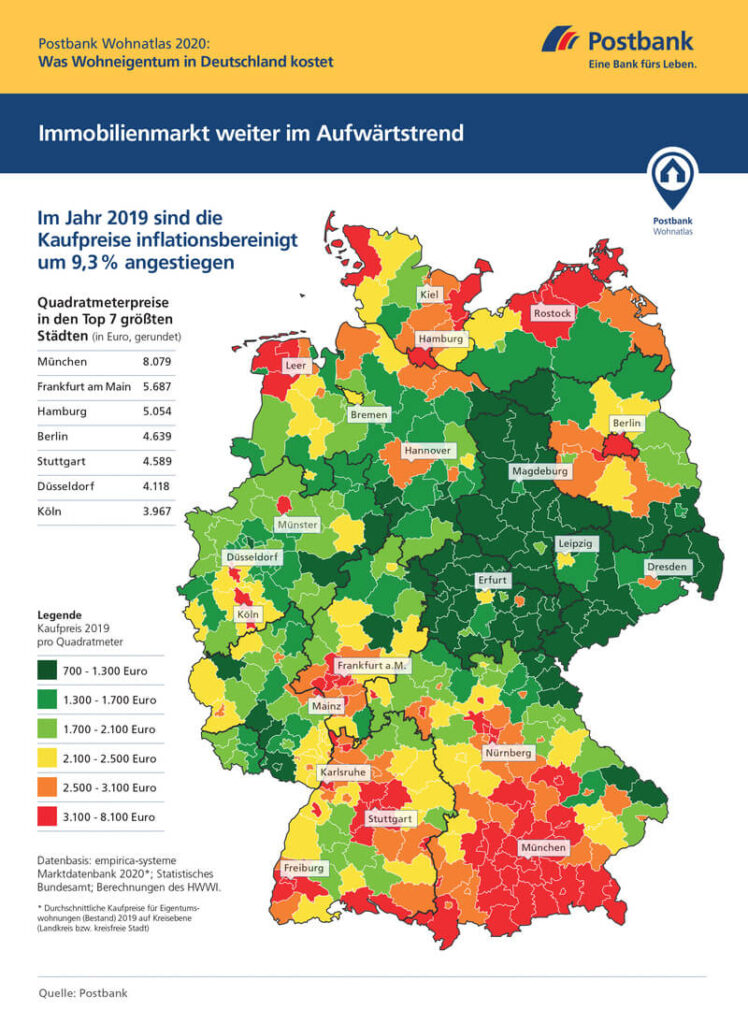

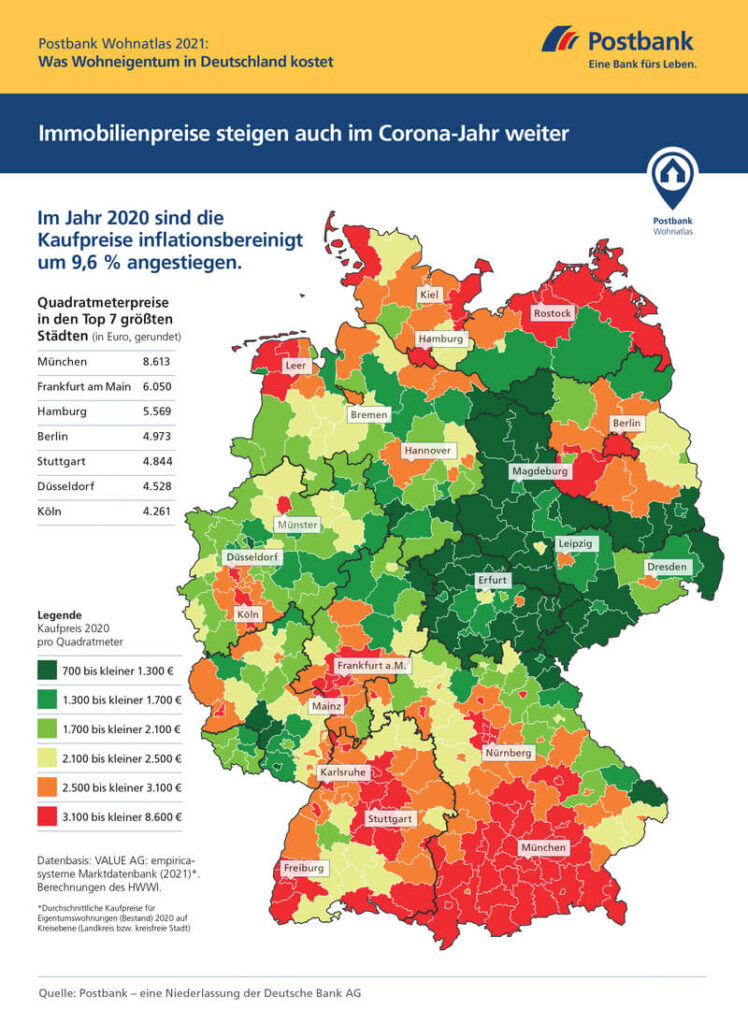

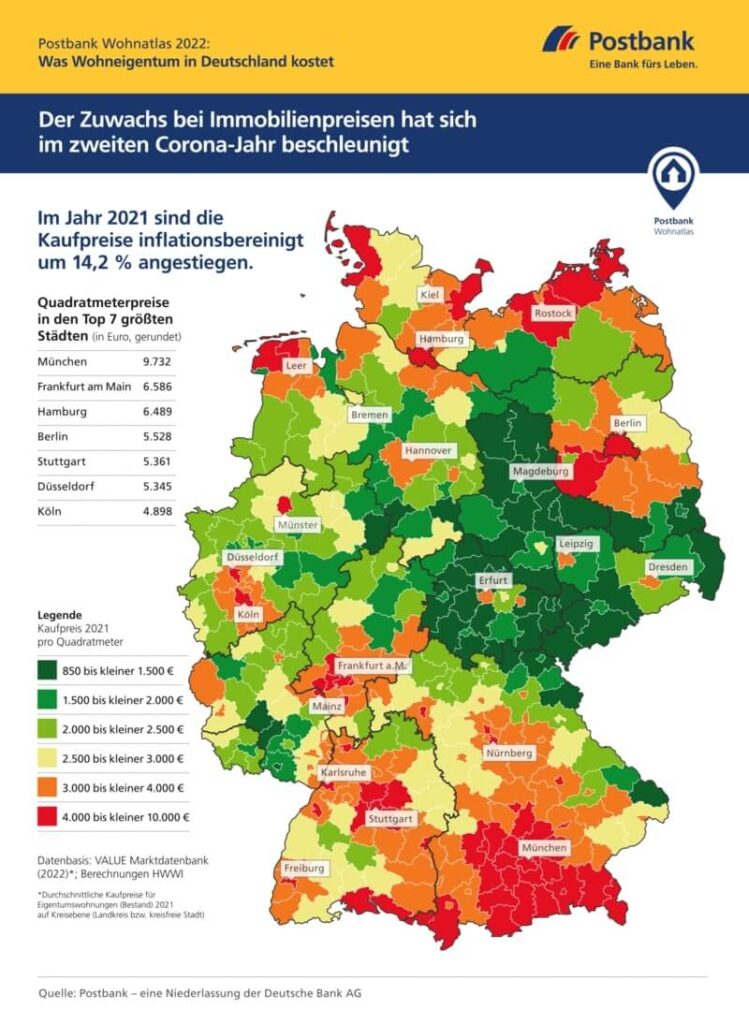

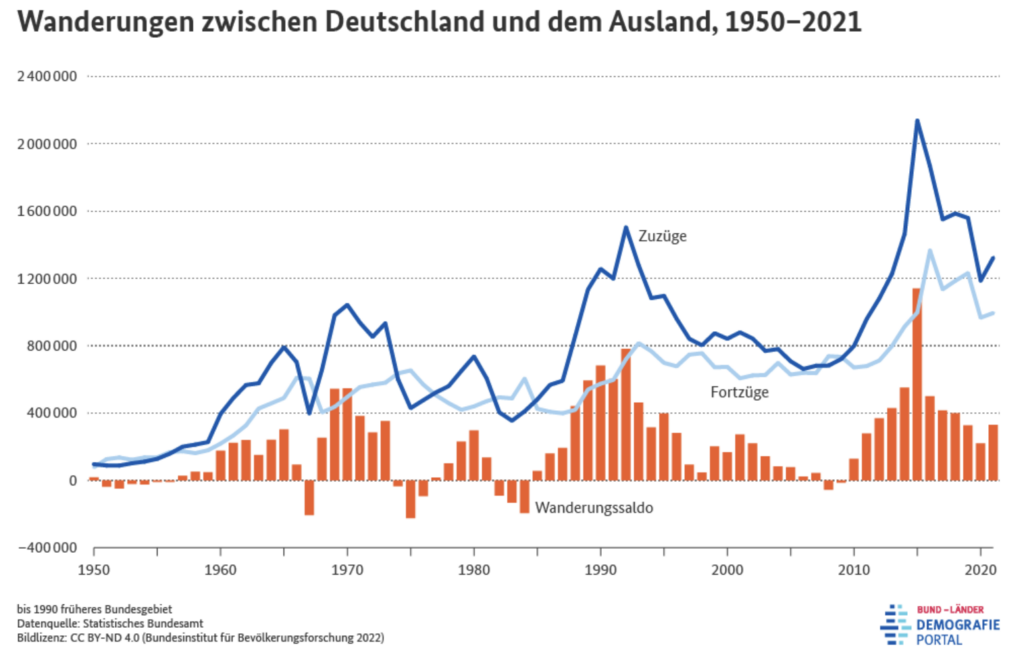

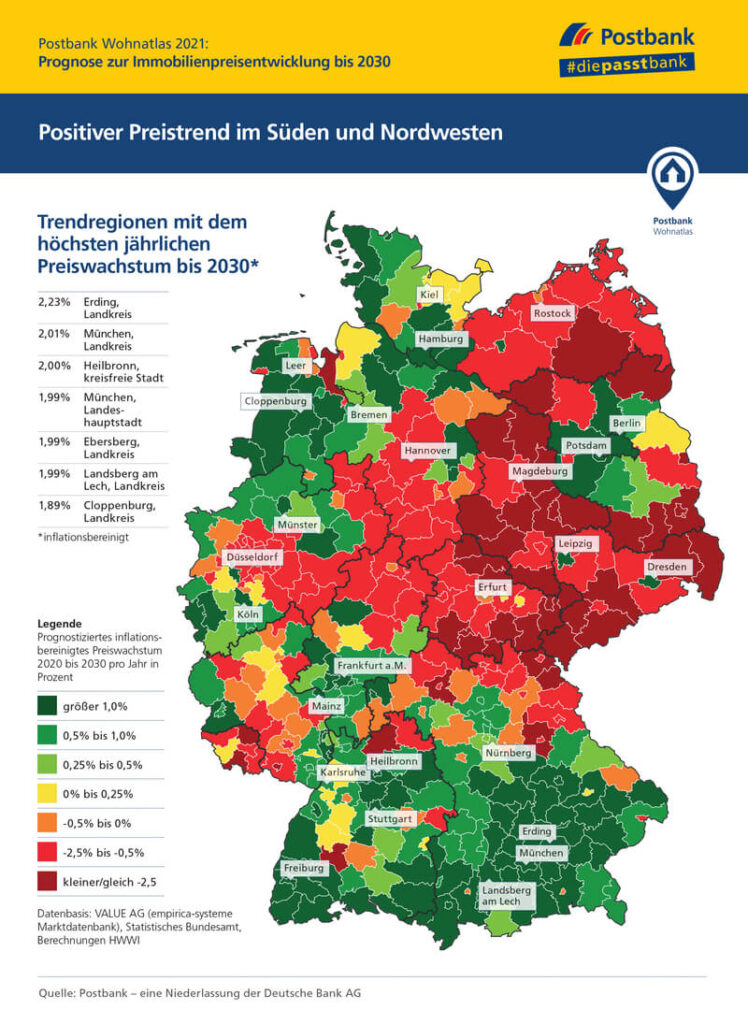

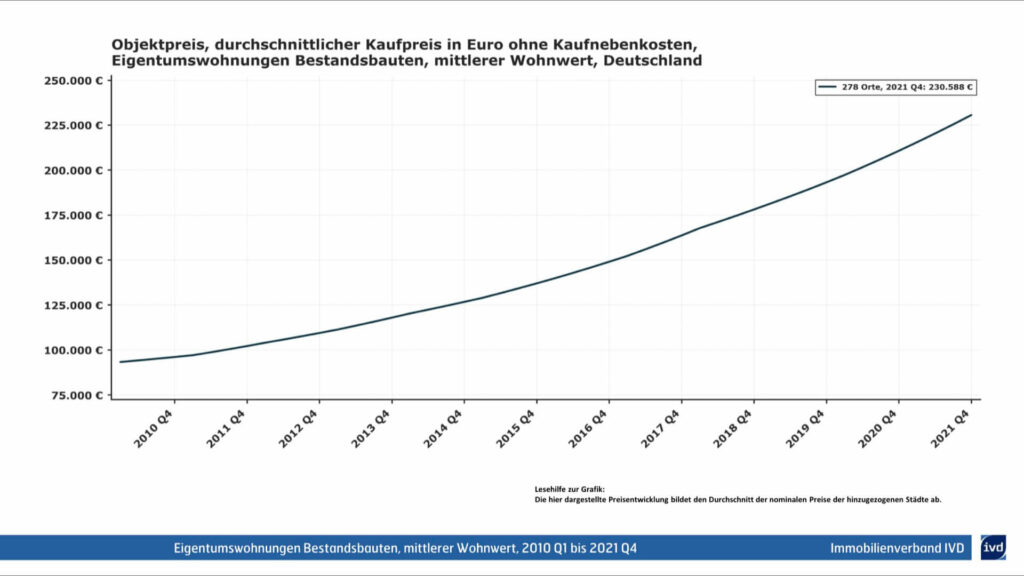

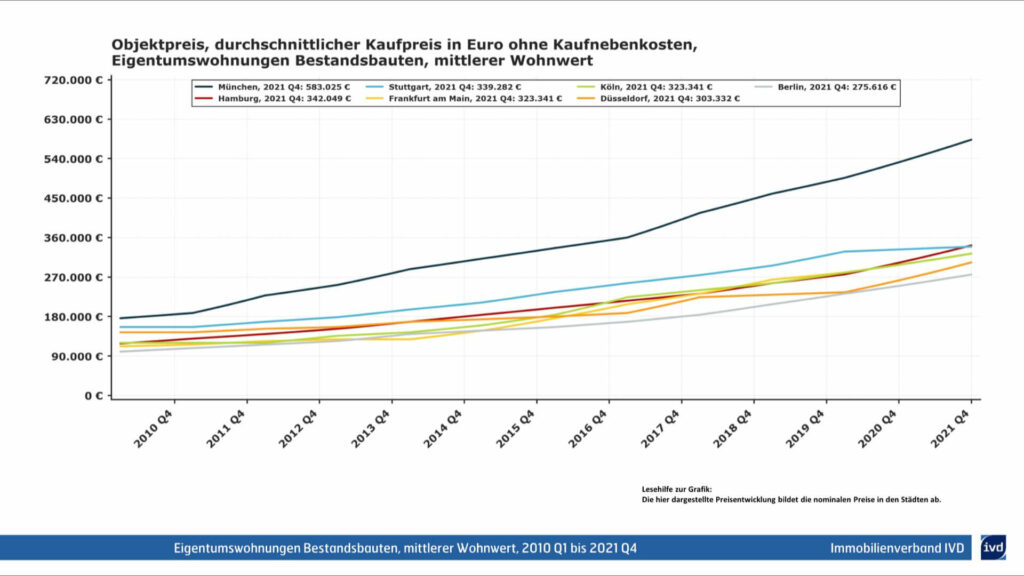

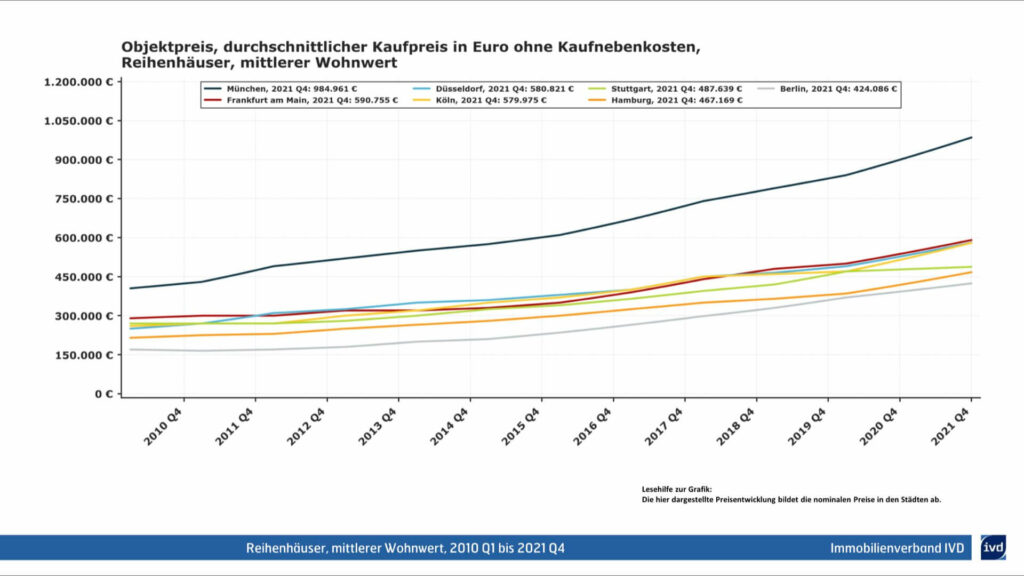

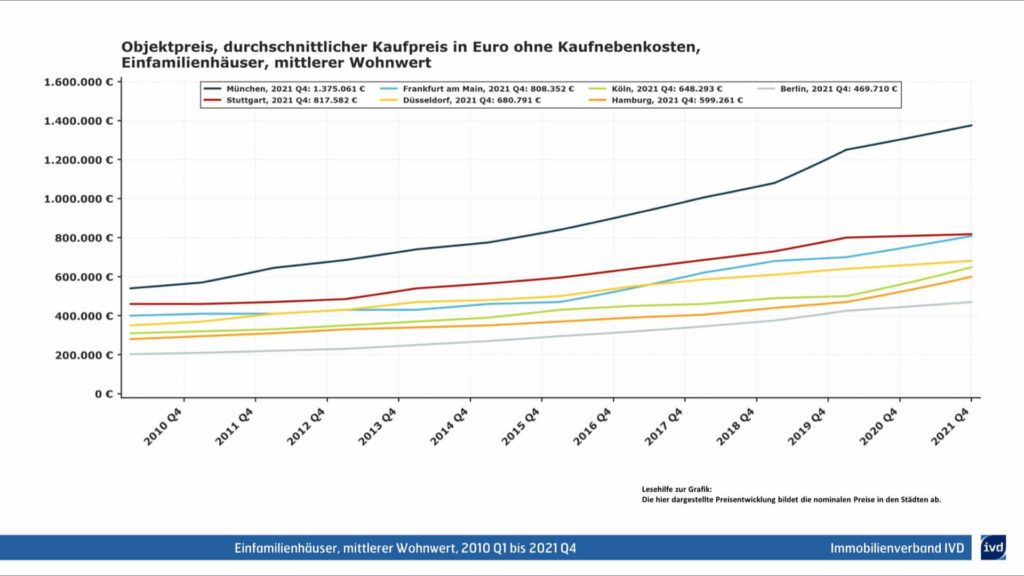

One notable finding of the podcast is the second-lowest homeownership rate in Europe at 49.9% (only Switzerland has an even lower homeownership rate). This statistic is of great importance for the formulation of property investment strategies. The low rate is attributed to the fact that homeowners have almost only disadvantages compared to property investors.

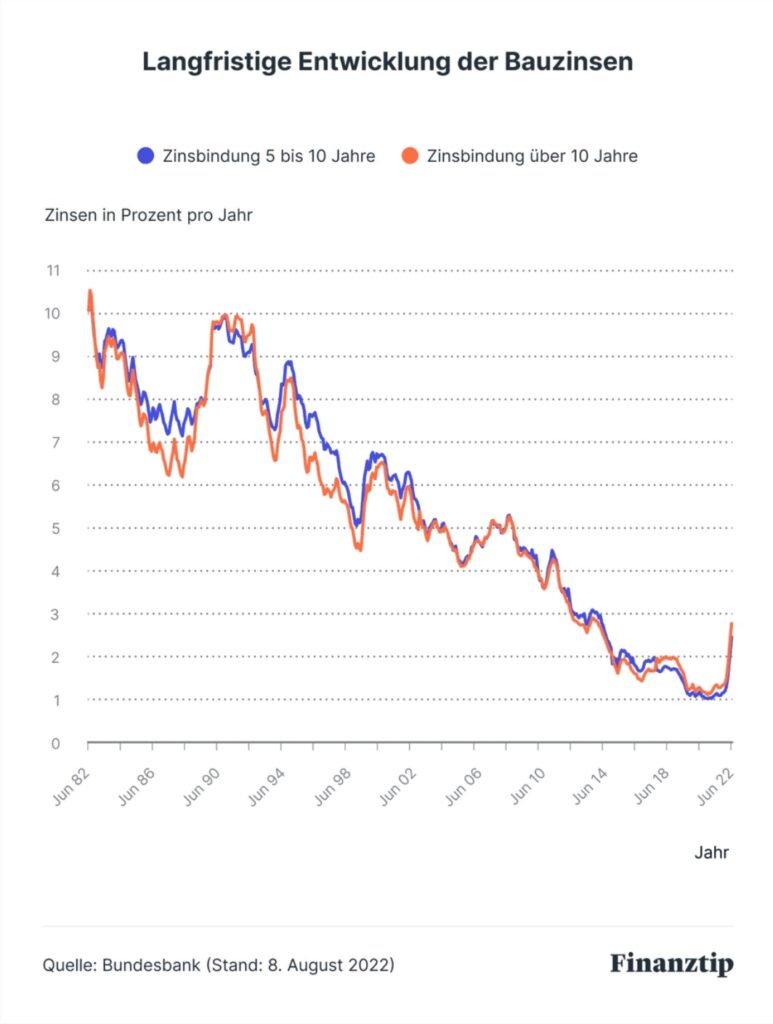

Over time, banks’ increasing down payment requirements have made homeownership more difficult to access, particularly in major cities such as Berlin and Munich. The advice to focus on property assets is clear: start with small rental properties. Take advantage of the associated tax benefits for property investors and consider the possibility of converting to home ownership later, if at all.

In the complicated world of property ownership, this strategic approach is proving to be a key maneuver in navigating the German property landscape and exploiting the potential for wealth creation.

How Rich Are YOU Compared To Other German Households?

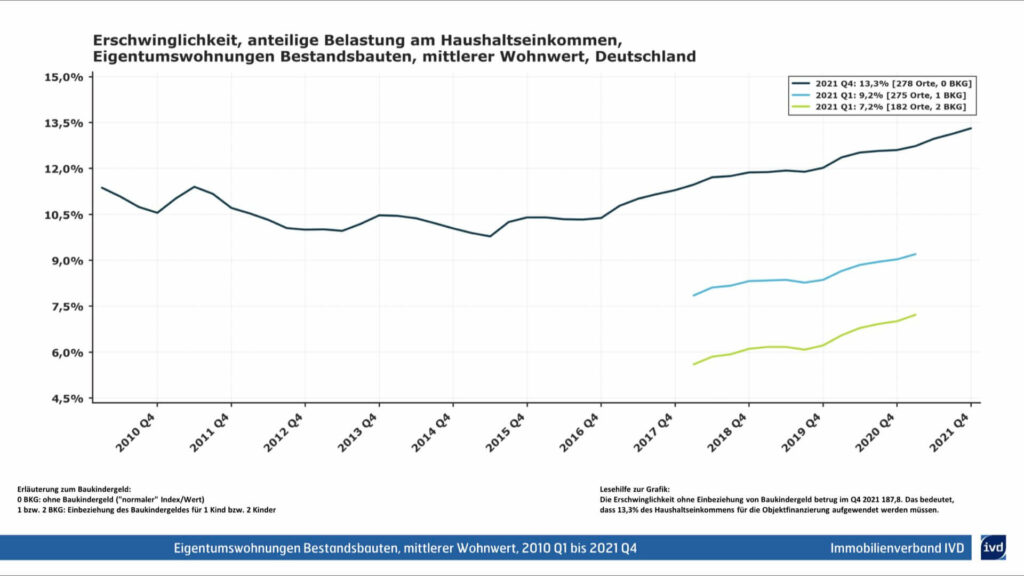

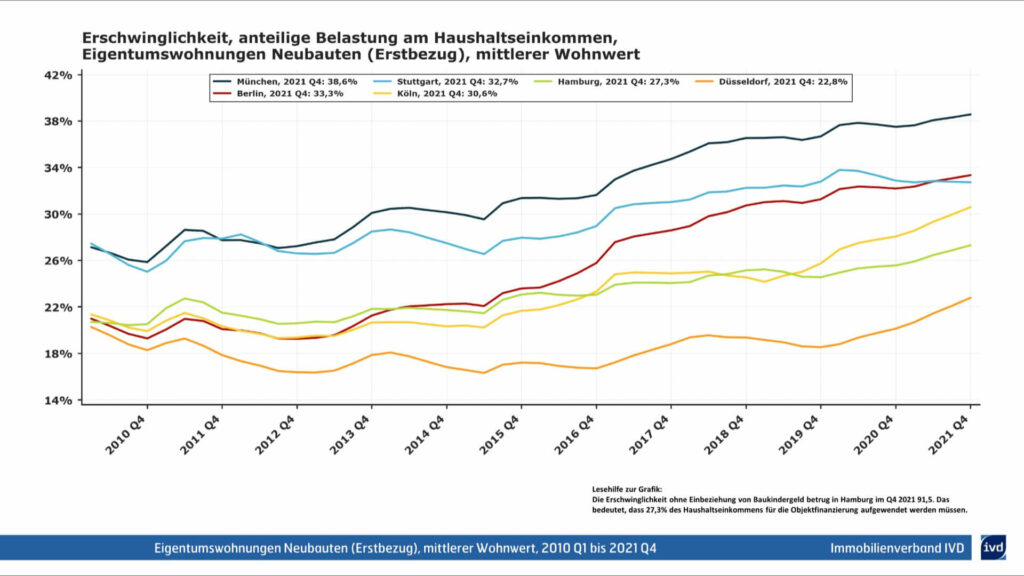

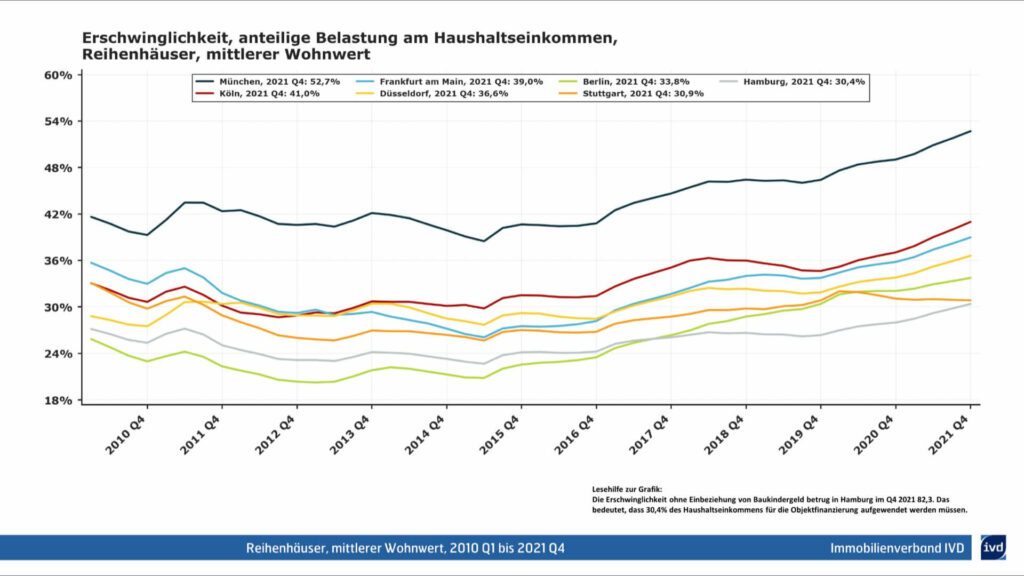

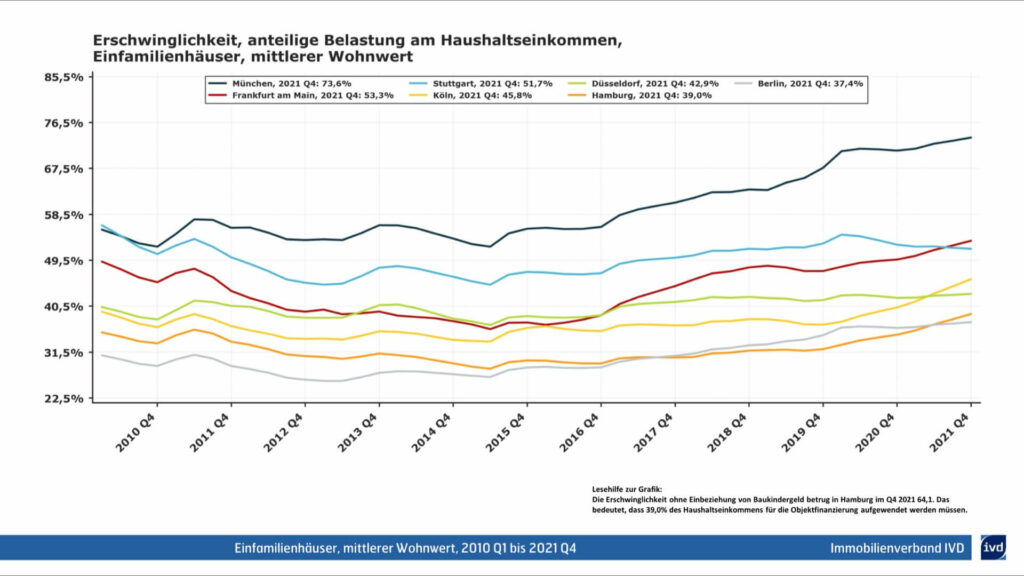

A look at the wealth distribution of German households reveals a convincing correlation between wealth and property ownership. A chart in the study by the German Institute for Economic Research illustrates the net wealth of households in various quantiles and reveals an important finding: the higher the wealth of households, the greater the importance of property in their portfolio.

The top 10% of households with net assets of EUR 1.85 million have a remarkable 60% of their portfolio in property investments, which clearly demonstrates this correlation.

This trend continues across all income brackets and emphasizes the fundamental role that property plays in the wealth creation process (see image). The pattern illustrates a strategic path for individuals looking to move up the wealth ladder in Germany and emphasizes the indispensable role of property in promoting financial prosperity.

3 Steps To Get Rich With Real Estate

The path to property wealth requires a strategic roadmap.

- Build +10k Equity: For those starting with minimal funds, our German property marketplace opens the doors to investment opportunities with as little as €100 and democratizes access to property ownership.

- Buy Your First (Rental) Property: In the second step, as your savings grow, you need to decide whether you want to buy a rental property or an owner-occupied home. This decision depends on your priorities: a lifestyle-oriented decision in favor of a home of your own or a financially-oriented decision in favor of a rental property. The latter proves to be advantageous as it brings you more benefits and can accelerate your path to financial prosperity.

- Scale To The Next Property With “Free Equity”: For those who want to be among the richest 10% of Germans, the way to go is to keep ownership of the property, pay off the mortgage diligently, and use the accumulated free equity to venture into the purchase of the next property.

This three-step strategy is a practical approach for people who want to navigate the complicated landscape of property in Germany and build lasting wealth.

Conclusion: How To Get Rich With Real Estate

To conclude this journey through the intricacies of property wealth in Germany, the symbiotic relationship between property ownership and prosperity is the central focus. As the findings of the German Economic Institute underline, property is an important part of the wealth portfolio of Germany’s affluent households. Our German property marketplace offers aspiring investors an easily accessible entry point to translate these findings into actionable steps.

The strategic decision-making process of whether to choose rental property or home ownership plays a central role in shaping one’s financial destiny. For those looking to move into the upper echelons of wealth, a disciplined approach that includes holding the property, paying the mortgage, and utilizing the equity accumulated opens a path to sustainable prosperity. When navigating the German property landscape, these insights serve as a compass to guide individuals toward informed decisions and ultimately the prospect of lasting financial prosperity.