Best Real Estate Locations In Germany Until 2030

German Property prices surged in the 2010s and early 2020s to unprecedented highs. Which locations will be the best until 2030 and what growth rates can investors realistically expect? 🤔

Key Takeaways

- After the tremendous property prices increases of the past, Postbank released new projections for 2030

- The 2010s were the golden ages for the German real estate market. Will that trend continue until 2030 and beyond?

- The start to the 2020s was difficult, but still real estate prices increased faster than ever before

- Until the year 2030, Postbank projects very low property price growth projections of not even 2% per year

Best Cities to Buy Investment Properties in Germany

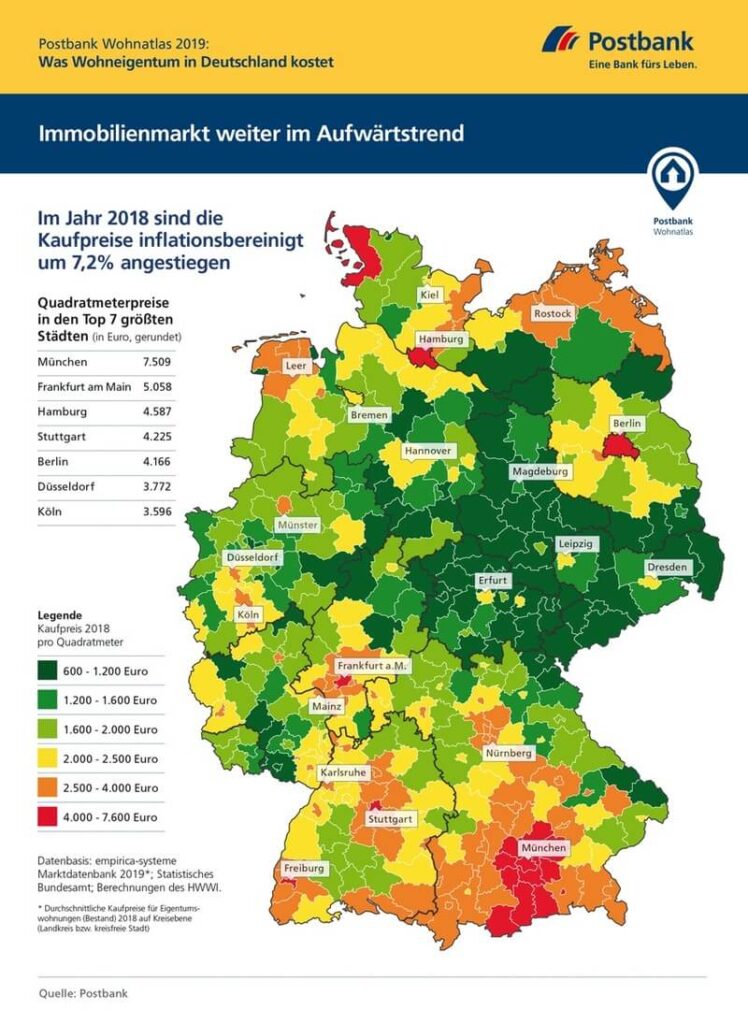

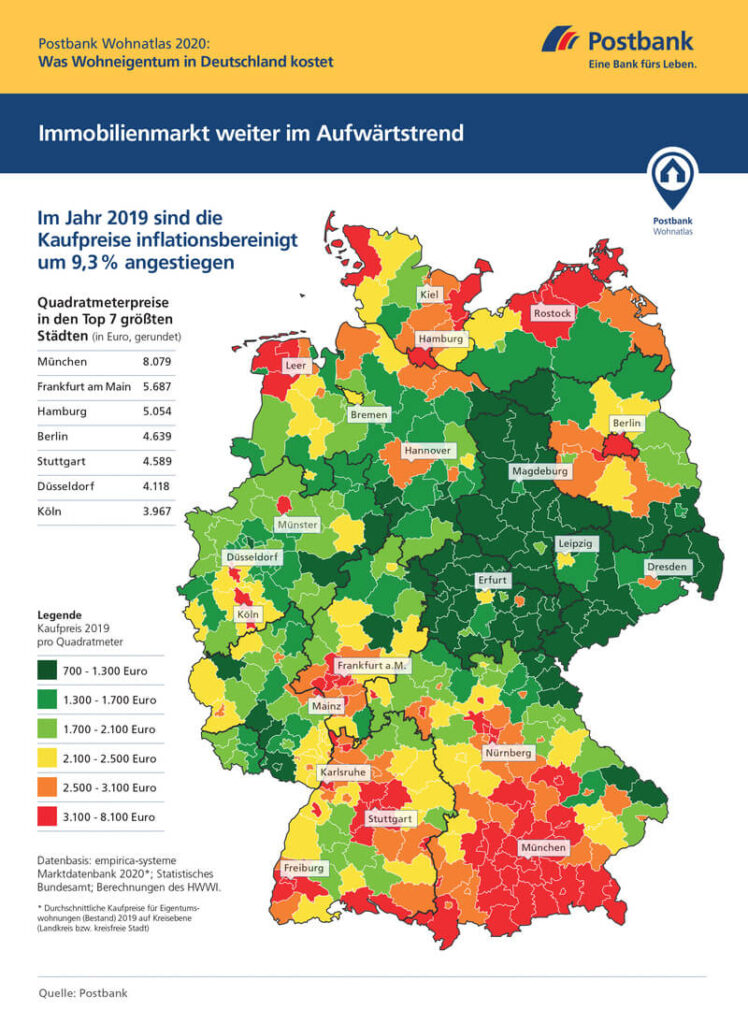

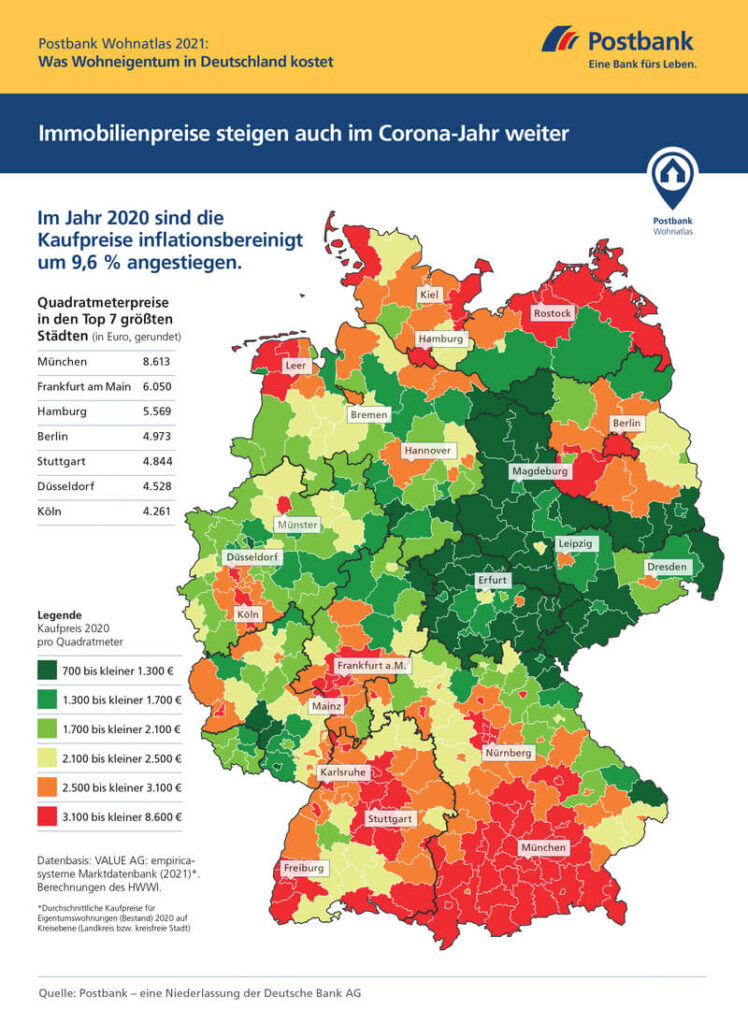

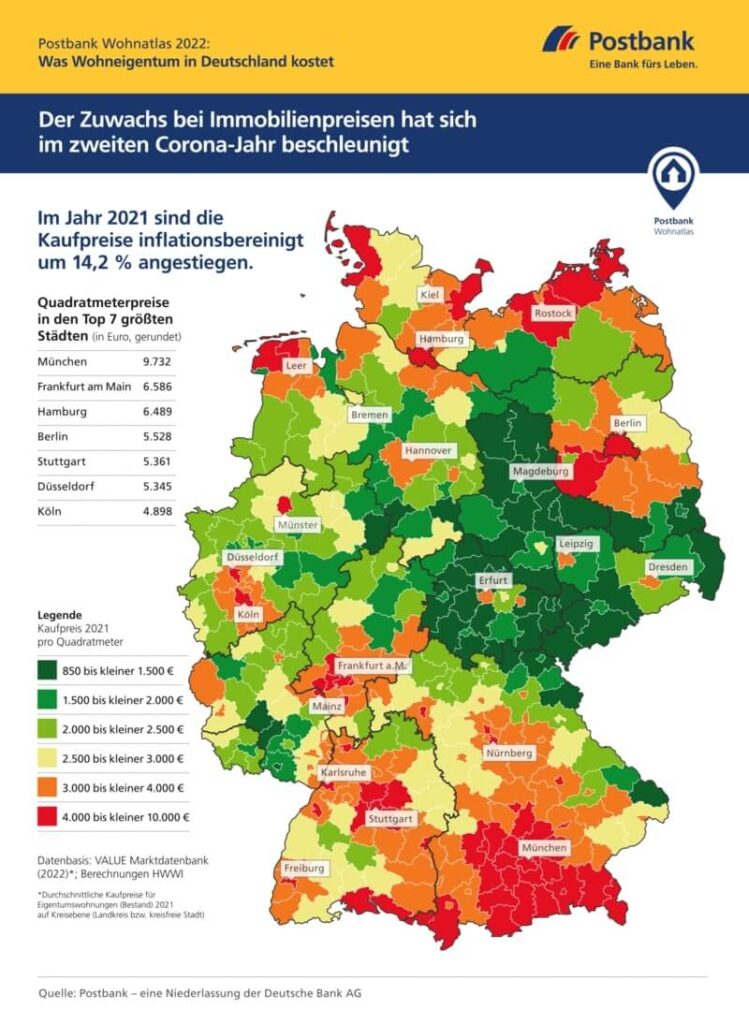

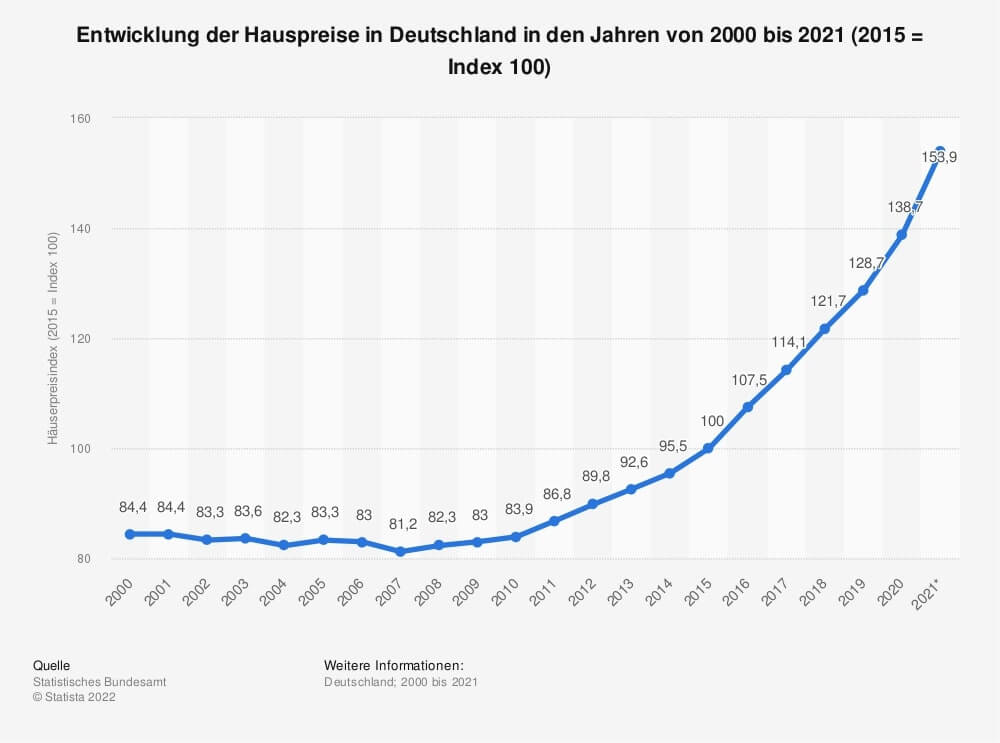

After the insane property price increases of the last years (+7,2% in 2018 up to +14,2% in 2021 as seen below), Postbank recently released a new map with the best real estate locations in Germany until 2030. Will property prices almost double in value by 2030, if the 2020 trend of +9,6% per year continues, or even rise by +142% if the 2021 trend of +14,2% continues (all percentages adjusted for inflation)?

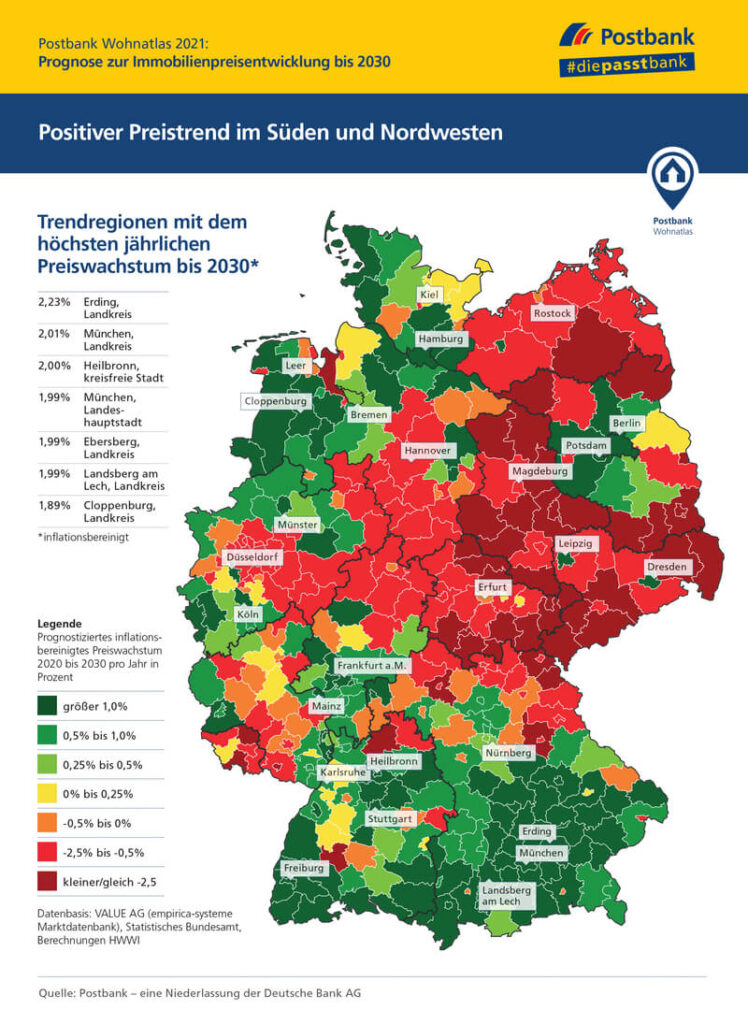

Before we get to the map of the best real estate locations in this GermanReal.Estate blog article, let’s give some context to Postbank’s numbers. Spoiler alert… Postbank barely projects a 2% increase in property value until 2030 for the best locations in Germany! 😱

How is that possible? Well, we also think the Postbank projections are low, but to understand their numbers, let’s recap how real estate was in the 2010s, how the German real estate market started in the 2020s, and what that might mean for 2030 and beyond. This context can help us to understand Postbank projections, and also to help you determine in which location you might want to invest right now.

German Real Estate In The 2010s: The Golden Ages

The 2010s started right after the Global Financial Crisis. The economy was booming, which means that people’s incomes rose as well. Earning more money was great as people also had more money to invest. The big question at the time was what to invest in when interest rates around the world were close to 0%. In the end, the stock market, the crypto market, and the real estate market all saw significant growth and increased investment.

To be more specific, the stock market experienced an unprecedented boom, with stock prices rising rapidly and making many investors wealthy. The crypto market also experienced rapid growth, with blockchain-based cryptocurrencies such as Bitcoin reaching new heights and becoming more widely accepted than before.

The real estate market also experienced a surge in prices, with the German house price index serving as a prime example. On the right, you can see the official graph of the German House Price Index to prove the point.

Property prices have almost doubled since the Global Financial Crisis and continued to increase faster than before in 2021 (same result as Postbank above).

Of course, there are also other reasons why property prices increased so much in the 2010s. Nevertheless, economics has a very strong part in it, as people thus have more money to invest in real estate.

To summarize the 2010s: When the economy is doing great, real estate generally also does great.

Our real estate security tokens allow you to invest in German real estate as easily as possible. Investing on our GermanReal.Estate marketplace starts at usually just 100€:

German Real Estate In The 2020s: Difficult Start

So, what about the 2020s? Well, it didn’t start that well with the COVID-19 pandemic. However, if you look at the Postbank maps at the beginning of this article, the pandemic didn’t do any harm to the German real estate market. Even during the biggest economic downturn since the Global Financial Crisis, the German property market remained pretty stable.

The stock market did drop significantly because stock markets react quickly to news events. However, the real estate market tends to be much slower to react to short-term events that last only a couple of years. In 2021, as the pandemic dragged on, even the resilient real estate market started to show some effects.

Subsequently, inflation started to rise from 0% to the 2% inflation target of the European Central Bank, to 5%, and then to more than 10% in October 2022. Rising inflation caused leading central banks around the world to increase interest rates in 2022 and 2023 as a response. Over the last two years, interest rates for real estate financing increased from about 0,5% to 4%. Insane!

Of course, Russia’s invasion of Ukraine in February 2022 is also pushing inflation even higher and is causing economies around the world to go down.

The 2020s didn’t have the greatest start for rising real estate prices, and it seems that the party of the 2010s is over for now.

This doesn’t mean that the real estate bubble is going to burst or that the real estate market is going to crash, but you can hear our take on that in this video.

German Real Estate in 2030: Low Growth Rates?

Now that we have some perspective on the real estate market over the last 10 years and the present, let’s look at Postbank’s projections for the best real estate locations until 2030 and beyond. Here is why we cannot completely agree with Postbank’s projections:

The map looks pretty red, and yes that’s bad. All red and orange areas are projected to have falling real estate values until 2030, after inflation that is. So, they could rise in nominal value, but realistically property prices are falling in the red and orange areas.

In the green areas, property prices are rising by the amount of up to 1% per year – and in the dark green areas by +1% per year. Extremely low compared to the property growth rates of the 2010s or early 2020s!

Four of the top five locations from the Postbank map are in or around Munich, with close to 2% growth per year. What do you think about these growth rates that you’re seeing here? 🤔

Let’s take the example of our capital city, Berlin. Berlin is a prime A-Location that has become more and more expensive over the years. It has become so expensive in fact that people have started buying properties in the surrounding areas of Berlin.

On the Postbank map, Berlin is dark green, and the areas around it are also green. We can agree with the map here. Same for Munich, Stuttgart, Frankfurt, and Hamburg.

But what about Düsseldorf which is currently the most affordable A-location in Germany? Is it really realistic that property prices around Düsseldorf are falling?

We certainly don’t think so and that’s why we issued our first real estate security token (Mönchengladbach: Welcome Home) as well as the first property of our second real estate security token (Community Portfolio: New Constructions) in the suburbs of Düsseldorf.

The most extreme example, and where we simply cannot agree with the Postbank map showing the supposedly best real estate locations in Germany until 2030, is the triangle of Leipzig, Dresden, and Chemnitz. This region experienced incredible growth over the last few years, and there’s no indication that this will stop anytime soon.

Our Predictions For German Real Estate until 2030

How realistic are the low property prices growth projections for the German real estate market of Postbank? Nobody knows the future! We’ll certainly be keeping an eye on developments in the German real estate market, and will post a video in 2030 looking at how the market developed!

What is our prediction? We think that real estate in Germany will experience at least double the growth rates that Postbank is projecting on its map! Come back to our website in 8 years to see who was right!

Pingback: Beste Immobilienstandorte bis 2030 | GermanReal.Estate

Pingback: How Inflation Impacts Real Estate Investors | GermanReal.Estate

Pingback: Global Real Estate Crash In 2023? | GermanReal.Estate

Pingback: Real Estate Affordability Index - We Clarify | GermanReal.Estate

Pingback: Passive Income & Real Estate: Is That Possible? | GermanReal.Estate

Pingback: Rising Real Estate Prices - Here Are the Best Tips! | GermanReal.Estate

Pingback: Real Estate Crash - All Information at a Glance! | GermanReal.Estate

Vielen Dank für die hilfreichen Informationen. Beste Grüße

Pingback: Real Estate With No Money | GermanReal.Estate

Pingback: Real Return of the German Real Estate Market

Pingback: Exploding Rents In Germany – German Income Vs. Rent

Pingback: 5 Tips for Successful Real Estate Investing in 2023: Expert Advice